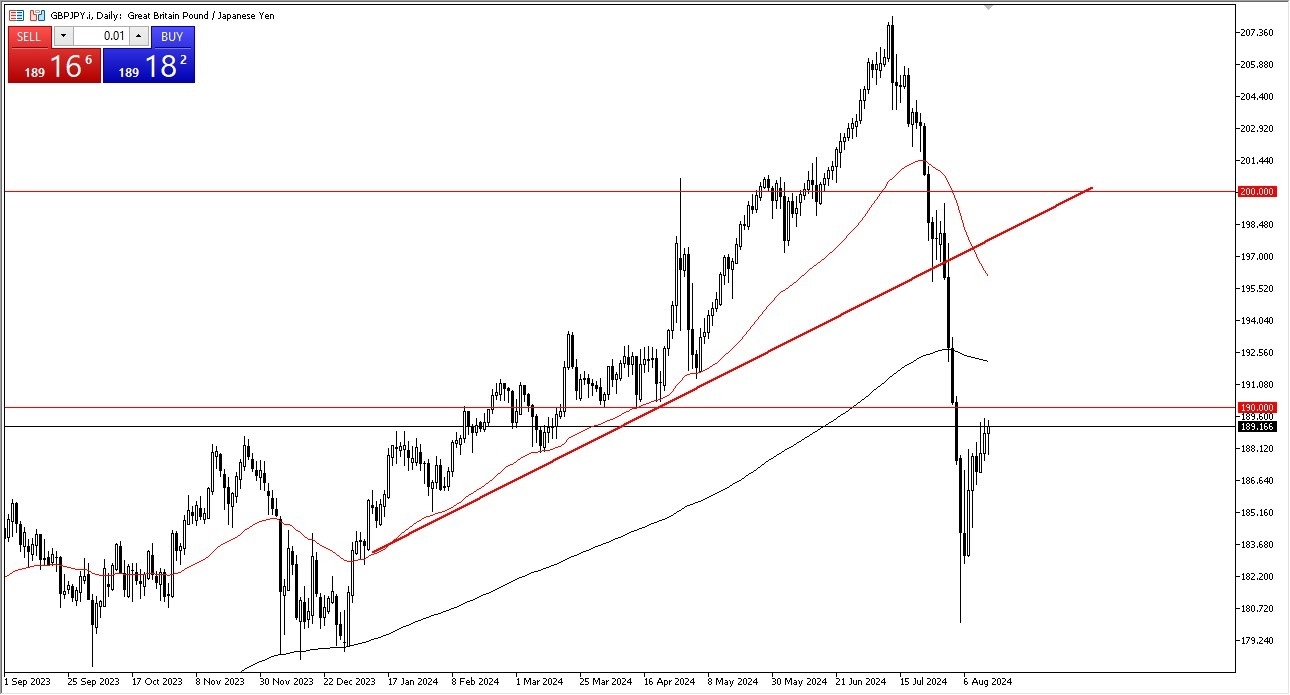

- The British pound has initially fallen against the Japanese yen in the early hours on Wednesday, only to turn around and show signs of life again.

- When I look at the pair, the first thing that I notice in my daily analysis is that the 190 yen level continues to offer a bit of a short-term ceiling.

- It is because of this that I am paying close attention to this level because if we can break above it, I think it brings in more FOMO trading, at least for the short term.

- Keep in mind, traders out there are still asking questions as to whether or not the carry trade can return, and that will be a big deal.

Potential Carry Trade Return?

This is a pair that the interest rate is wide enough to drive a semi-truck through. So, you obviously get paid quite well to hang on to it. The Bank of Japan has recently started to tighten monetary policy, but the reality is that they probably can't do it for a significant amount of time. So, I would anticipate that sooner or later the carry trade does come back into vogue. If and when that happens, then this is a pair that could make new highs.

Top Forex Brokers

Do not get me wrong, though, I don't think that happens easily, nor do I think it happens in the short term. In the short term, I would anticipate more of a buy on the dip attitude, but if we were to break down below the 182 yen level then I think we began the next leg lower.

We have seen a lot of destruction in this pair and all Japanese yen related pairs So at the very least I think you're going to see traders be a bit hesitant to get involved to the upside However, there will come a point where it becomes obvious that the momentum has picked back up and traders will almost certainly do what they normally do and take advantage of the interest rate differential in the currency pair.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with