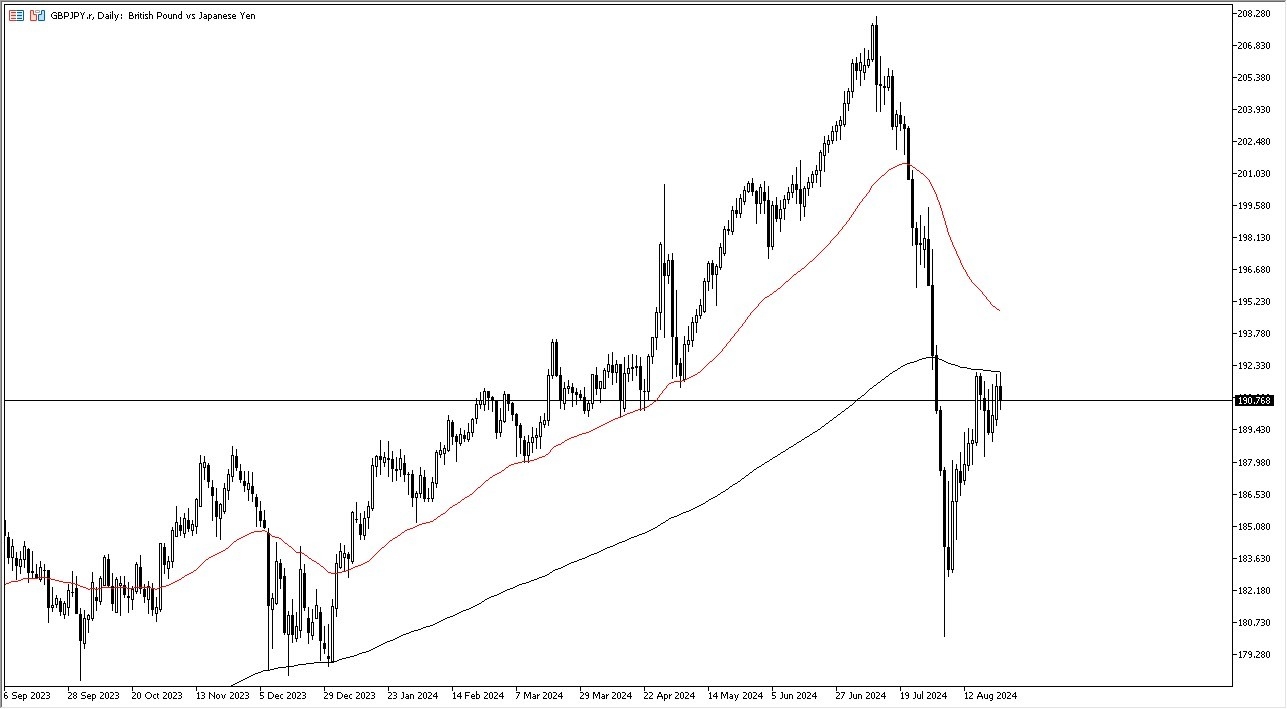

- I can see that we initially tried to reach the 200-Day EMA and break above it.

- However, we have failed from there and it looks like we are going to continue to be very noisy overall. If that’s going to be the case, then I think you’ve got a situation where traders are going to continue to look at the 200-Day EMA as important, as it is a large indicator that a lot of people will be paying close attention to.

If we can break above the 200-Day EMA on a daily close, then I think you’ve got a real shot at this pair going much higher. If and when that happens, then you’ve got a real shot at the market going toward the ¥195 level above, which is sitting right around the 50-Day EMA. Anything above that level opens up a much bigger move, and it probably means that we are now back into the “carry trade.”

Top Forex Brokers

All things being equal, this is a pair that I really like to hold, but I also recognize that we would see a lot of technical damage to it over the last several weeks, as the Bank of Japan decided to finally tighten monetary policy somewhat. With this being the case, I think you’ve got a scenario where the market is likely to be a bit lackluster, and you have seen over the last week or so that we have just been shopping back and forth. With that being the case, it’s very likely that you have a market that is trying to build up enough momentum to go somewhere, but we don’t necessarily know where that direction is.

Possible Scenarios

Keep in mind that we need a little bit of a “risk on rally” to send this market higher, as traders tend to buy into this pair when they feel fairly confident. There are a lot of moving headlines out there that could cause major issues, so therefore you need to be very cautious about what you do next. The market breaking above the 200-Day EMA could very well send a rush of “FOMO trading” into the currency pair, but I also recognize that there is a lot of nonsense out there that could cause a bit of a headache.

If we break down below the ¥186 level, then I think we probably plunge toward the ¥182 level, where we had bounce from previously. If we break down below that level, then I think this pair unwinds quite drastically.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.