Potential signal:

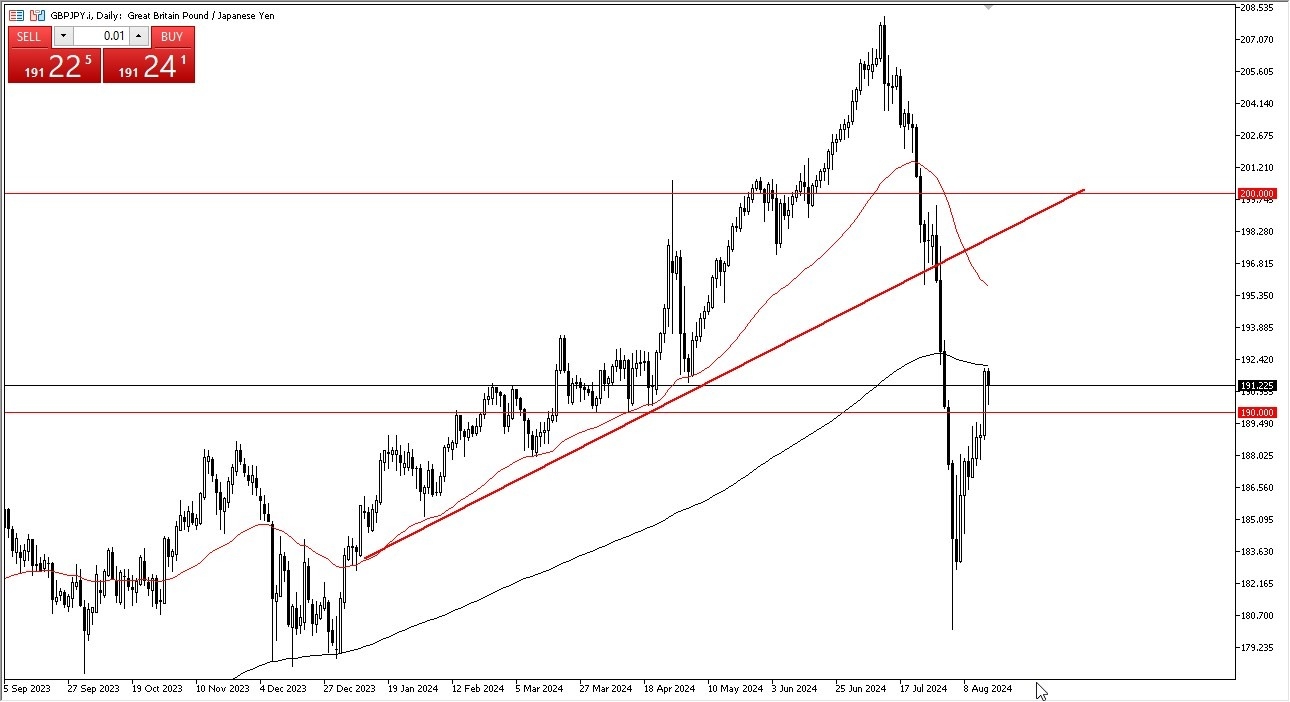

- I am a buyer of this pair on a daily close above the ¥192.42 level.

- If we can break above there, then I would have a stop loss at the ¥190 level and would aim for a move to the ¥195.45 level.

- The British pound has fallen a bit during the early hours, and the ¥190 level seems to be offering quite a bit of support.

- Furthermore, we also have the 200-Day EMA above, and if we can break above there, then it’s likely that we could see this market truly break down to the upside.

Top Forex Brokers

The resulting candlestick does look a little bit like a hammer, but more importantly, it shows that buyers are willing to jump in and take advantage of “cheap British pounds”, against the lowly Japanese yen. Granted, the recent unwind of the carry trade has been rather brutal, but you still get paid to hang on to this position, so I think it’s probably only a matter of time before we see traders jumping in and taking advantage of that. With that being said, the market breaking out above the 200-Day EMA could open up the possibility of a move toward the ¥195 level. In that area, the market is likely to continue to see the 50-Day EMA as a major resistance barrier.

Carry Trade

The real question right now is whether or not the carry trade is going to return. Remember, you get paid to hang on to British pounds instead of the Japanese yen. Furthermore, lot of the larger institutions will borrow in Japanese yen and invest in Great Britain. This means that they can get a somewhat “risk-free return” by simply buying British gilts using those Japanese yen. At the end of the day, when there is a bit of a panic, they rush back to Japan to pay off all of those loans.

Ultimately, this is a market that I think continues to see a lot of volatility, but I will be watching the 200-Day EMA very closely, because I think it is worth quite a bit when it comes to the psyche of the market as well. At this point, I am more bullish than bearish, but I also recognize that it is probably not going to be an easy road higher.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.