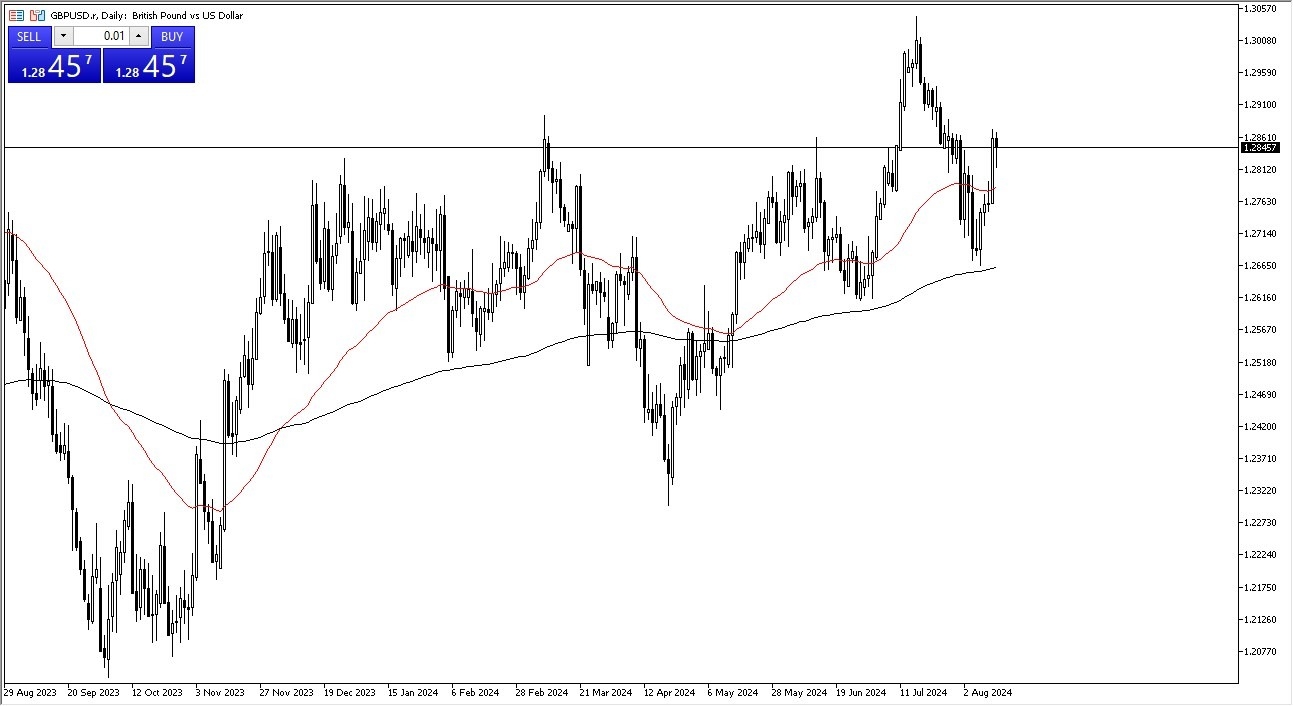

- The first thing I see is that we had sold off early in the trading session, but we have turned around to show momentum yet again.

- Because of this, it looks as if the market is going to continue to favor the upside in general, but I am aware that there are a few places that we need to pay close attention to on the chart.

- The first place that I am watching with great interest is the 1.2875 region, because we can break above there, then it’s likely that more momentum will enter the market.

Retail Sales and Unemployment Claims

On Thursday, we will get vital information coming from the United States that could greatly influence where this market goes. While the default scenario at this point in time is that the Federal Reserve cut rates in September, the Retail Sales figures and of course the Weekly Unemployment Claims number could give us a bit of a “heads up” as to whether or not the Federal Reserve will continue to cut rates beyond the September meeting. In other words, this is a situation where traders are more likely than not to continue to pay close attention to the directionality of the US economy.

Top Forex Brokers

That being said, there does come a point where the US economy falling is actually a bad thing for all risk appetite, and you will more likely than not see money running back into the Treasury market, meaning that the US dollar could strengthen. Having said that, I don’t think that’s the short term bias, and it looks as if we are going to eventually try to break to the upside, perhaps aiming for the crucial 1.30 level above.

The 1.30 level of course is a large, round, psychologically significant figure, but it’s also worth noting that it has been pierced previously over the last couple of months. Short-term pullbacks at this point in time should continue to see plenty of support near the 50-Day EMA, perhaps even down at the 200-Day EMA which is closer to the 1.2675 region.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.