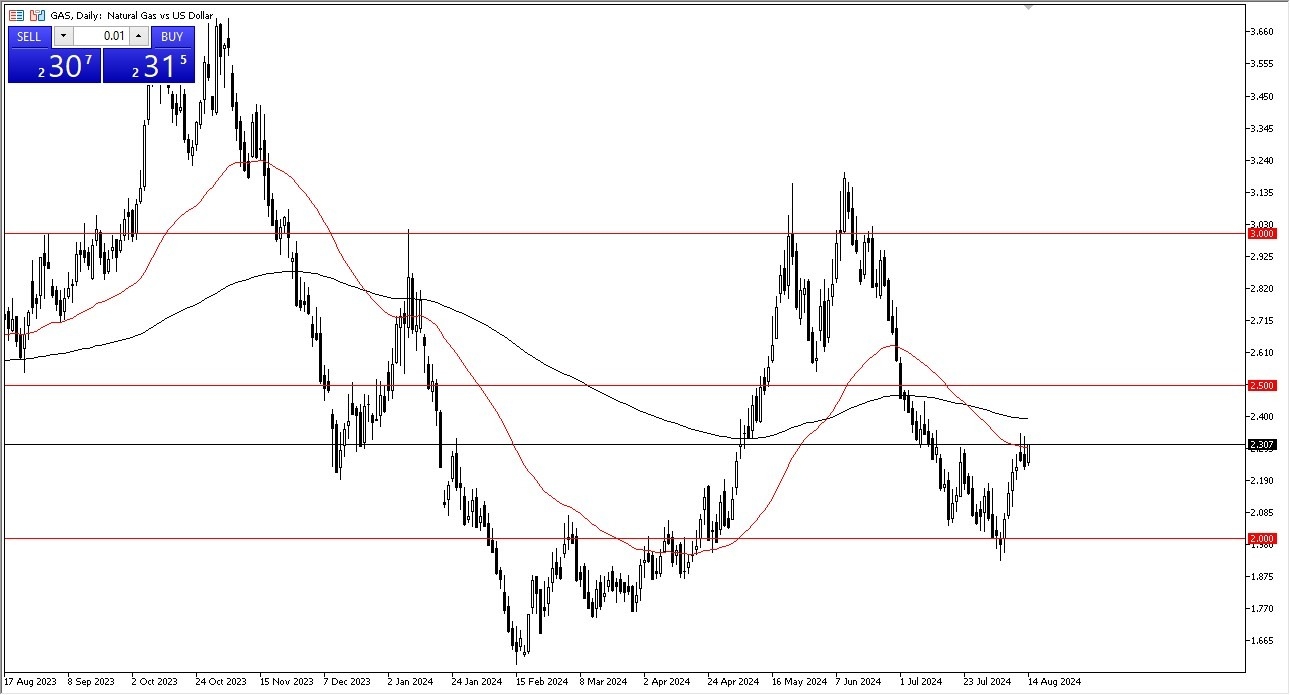

- Natural gas markets have had a bullish turn of events during the early hours on Wednesday, as we continue to try to break above the 50 day EMA.

- The last couple of sessions ended up forming shooting stars and the Wednesday session rallying looks like it's running into a bust saw of resistance.

If we can break above the two candlesticks from Monday and Tuesday, then we could go higher, perhaps reaching the 200-day EMA. If we can break above the 200-day EMA, then it opens up the possibility of a move for natural gas to the $2.50 level. The $2.50 level, of course, is a large round number that I would anticipate there should be a significant amount of options barriers there. Short-term pullbacks, and I think it is very possible that we get those, should end up being buying opportunities for those who are willing to look at natural gas from a longer-term perspective. Natural gas is a very difficult market to trade from the short-term because it relies so heavily on weather patterns, which, quite frankly, the weather patterns are in the northeastern part of the United States, and the weather in this part of the world is not that stable most of the time.

Top Forex Brokers

It Can Be Difficult

So, because of that, things can be very difficult. In the short term, pullback has me buying more of a position as I have already started the ETF positions because I can avoid the leverage later in the year. We typically get a massive shot higher in natural gas, and I will just simply get rid of my position at that point. This is an investment and not a short-term trade, and I would implore you to look at it through the same prism. Over-leveraging yourself in the natural gas market is a great way to blow up your trading account. I've seen multiple people flood my email box with statements like, I have levered a position in natural gas, and presently I am almost completely blown up, what can I do? And my advice is always the same. Don't do it in the first place.

Low leverage is an absolute necessity in the natural gas markets because of the inherent volatile and dangerous nature of it. That being said, if we break the top of the previous two candlesticks that would be a very bullish short-term signal. Underneath, I would anticipate that the $2.20 level and most certainly the $2 level both could bring in a longer-term buying opportunity.

Ready to trade daily Forex forecast? Here’s a list of some of the best commodities brokers to check out.