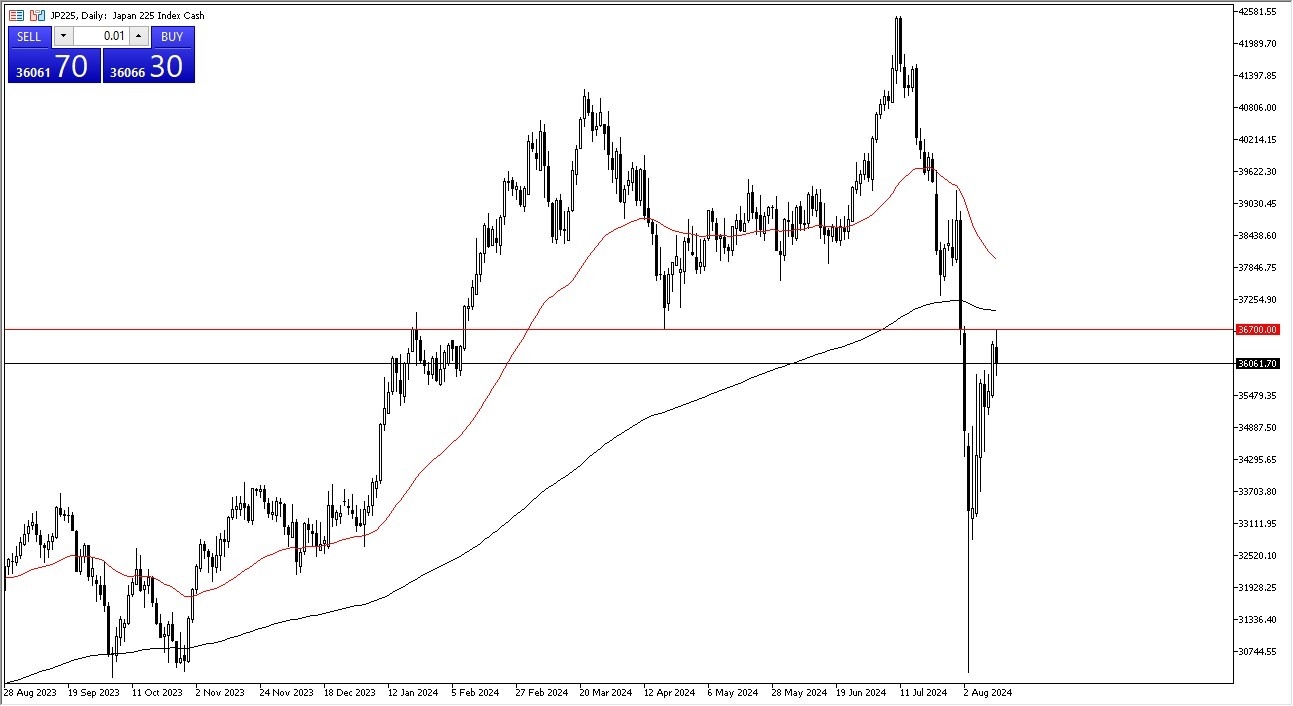

- The first thing I notice is that the ¥36,700 level has offered a significant resistance, which is interesting considering that the market has seen that level as important multiple times.

- Remember, the last couple of weeks have seen the carry trade unwinding quite drastically, meaning that Japanese equities have been absolutely hammered due to a rising yen.

- The Japanese economy is almost solely built on exports, so it Japanese good start to get more expensive for other places around the world, that does not do favors for companies like Sony or Honda.

Technical Analysis

The technical analysis for this asset is very interesting at the moment, because we have seen such a massive selloff that sooner or later, we had to see some type of bounce. Whether or not the bounce is going to be able to sustain itself has a lot to do with whether or not the carry trade itself can continue. In other words, you need to look at all the JPY -related pairs out there, to see whether or not the Japanese yen continues to lose strength. If it does, that will help the Nikkei 225 turn around and go higher.

Top Forex Brokers

However, keep in mind that the 200-Day EMA is sitting just above the crucial ¥36,700 level, and could offer a significant barrier. Breaking above that would obviously be very bullish, and at that point in time I think you could see a little bit of momentum jumping into this market. Ultimately, breaking above there then opens up the possibility of a move to the 50-Day EMA, which is currently near the ¥38,000 level.

I think the only thing you can count on at this point in time is that the Nikkei 225 will be very volatile, because quite frankly there has been such a massive “shot across the bow” from the Bank of Japan recently. At the end of the day, this is all about the Japanese yen in the carry trade, so you will have to keep all of these charts up at the same time to make a decision in this stock market, but quite frankly this one could be a mover.

If we were to break down below the ¥35,000 level, and we see the JPY -related pairs all start falling, that means we have much further to go to the downside, probably not only here but in most risk assets as well.

Ready to trade the daily analysis & predictions? Here are the best CFD brokers to choose from.