The USD/MYR has run into durable support levels the past couple days of trading, but its bearish trajectory lower has been strong and speculative questions now must be considered.

- In the middle of July the USD/MYR currency pair was trading near the 4.6935 mark as it began to show signs of selling pressure build.

- Resistance had become durable and the currency pair around the 23rd of July began to incrementally move lower.

- An inflection point for financial institutions and speculative traders may have occurred on the 5th of August, because as many currencies struggled against the USD, the Malaysian Ringgit showed definite strength as it suddenly move to a depth of nearly 4.4000.

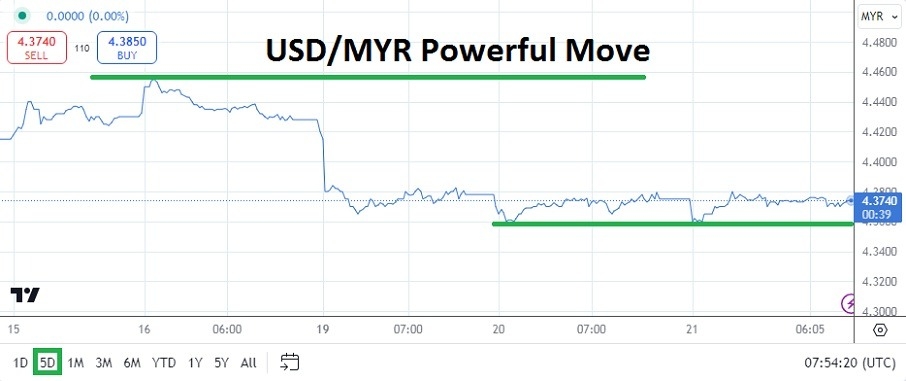

And on last Friday the USD/MYR traded in the lower realms of its price range between 4.4300 to 4.4500 and finished the week near lows displaying solid behavioral sentiment. Remaining potentially bearish and watching global Forex continuing to show rather weak USD centric sentiment, on Monday swift price action lower again occurred and a depth of 4.3700 was challenged. As of this writing the USD/MYR is around the 4.3740, continuing to demonstrate the ability to sustain fresh lows.

Top Forex Brokers

USD/MYR Lower Price Range and Long-Term Values

As the USD/MYR trades near values it last touched in early February of 2023, technical traders will have to rely on long-term charts to get a feel for where financial institutions may start to target values. The currency pair has shown a significant amount of bearish capability in the past month, as it has gone from being within sight of all-time highs which were achieved in April of this year, back to realms which open the possibility of more downside.

Perspective will be important for traders and this includes timeframes. The USD/MYR march into higher price ranges occurred as the U.S Fed refused to consider a change to their Federal Funds Rate and Asian economies were dealing with inflation and weaker economic results over the past two years. The ability to begin stepping down from higher price levels and now challenge lower values is important.

USD/MYR and Behavioral Sentiment a Crucial Part of Puzzle

The U.S Fed will release its FOMC Meeting Minutes report later today, but it may not create too much impetus. Financial institutions believe the U.S central bank will have to cut its interest rate in September and have begun to lean into the notion the Fed will turn outwardly dovish. But for the U.S Fed to become aggressively dovish and consider further interest rate cuts the U.S economic data will need to continue to be weaker than anticipated.

- Financial institutions seem to believe the USD/MYR has more room to traverse lower.

- The currency pair lingering near short-term lows is a sign the USD/MYR could touch lower realms.

- Traders should not be overly ambitious, but the use of quick hitting trades while using stop losses will help guard against sudden reversals higher which will certainly be seen once in a while.

USD/MYR Short Term Outlook:

Current Resistance: 4.3800

Current Support: 4.3710

High Target: 4.3850

Low Target: 4.3660

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.