The USD/PKR continues to offer speculators a chance to wager on direction within its tight price range, while the currency pair also offers the prospect of different perceptions.

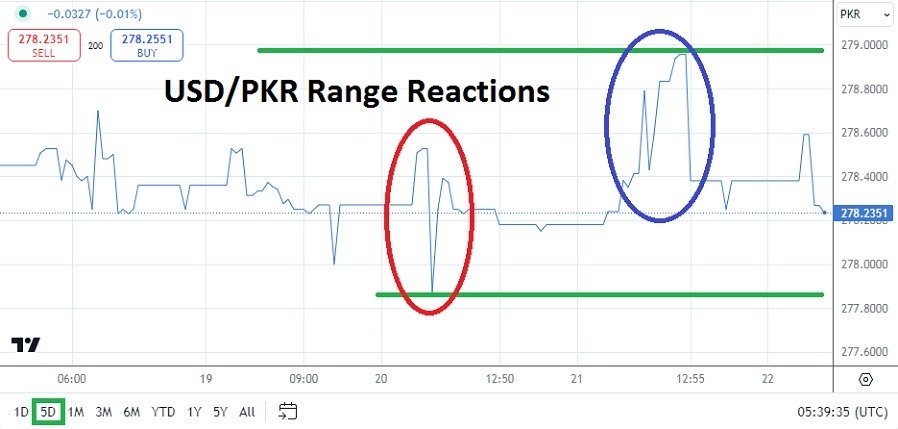

- The price range of the USD/PKR exchange rate remains a bit like a rubber-band. One moment the currency pair is testing a low within its limited near-term range, the next moment a price fluctuation brings the USD/PKR towards resistance and sometimes penetrates highs.

- Speculators who are pursuing the currency pair and have the ability to use entry orders and take profit targets may find the USD/PKR attractive.

No, the USD/PKR still does not offer traders the ability to move fast. Entry price orders must be filled and then risk management needs to be arranged via the knowledge the USD/PKR may not move in the intended direction for about a day or so. Nevertheless, the currency pair does continue to display the ability to react to support and resistance levels with regular reversals. Sudden changes of price are common too.

Top Forex Brokers

New Near-Term High and USD/PKR Speculative Consideration

As of this writing the USD/PKR is near the 278.2351 ratio. The currency pair has moved lower today, but this occurred after the USD/PKR hit a high of nearly 278.9590. Highs seen occasionally this week have tested resistance which was seen in June and July. However, after these apex marks have been challenged the moves lower have returned the USD/PKR to ratios which appear ready to test depths seen earlier this week.

Technical traders have an advantage with the USD/PKR, because it is hard to speculate on the currency pair via fundamentals. Unless a trader has inside knowledge of the Pakistan Central Bank, it is nearly impossible to have transparent information regarding its intentions on a day to day basis. Instead, technical traders can look at one week, and monthly charts to gather perspectives. Traders may believe via recent mid-term charts that incrementally the support levels have begun to rise and resistance is being tested higher. However, it is dangerous to assume current levels will always remain durable.

USD/PKR Correlations Do Not Really Exist with USD Centric Attitudes

Traders need to understand the USD/PKR does not correlate to the broad Forex market. The price of the currency pair remains powered by the whims of the Pakistan government which controls the economy with strict oversight. The recent ability of the USD/PKR to test higher marks does not mean it is going to suddenly create price velocity upwards and bursts violently through its known price range.

- Support and resistance levels continue to provide traders with the patience to withstand overnight positions, the ability to speculate on reversals in the USD/PKR.

- Traders must brace their risk management with stop losses, because the pursuit of the currency pair may not go as planned, but from a technical perspective via one week and monthly charts there is often a return to the known price range in the USD/PKR.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.4000

Current Support: 277.9690

High Target: 278.9100

Low Target: 277.8500

Ready to trade our daily forex analysis? Here are the best forex trading brokers in Pakistan to choose from.