- In my daily analysis of the world’s indices, Paris has caught my attention as we have bounced after we had seen such a massive amount of negative pressure over the previous 4 sessions.

- That being said, the market is likely to continue to see a lot of noisy behavior, but I do think that given enough time, we will have to make a bigger decision.

- There are a couple of levels that I will be paying close attention to in the CAC 40 before putting a position on in either direction.

Technical Analysis

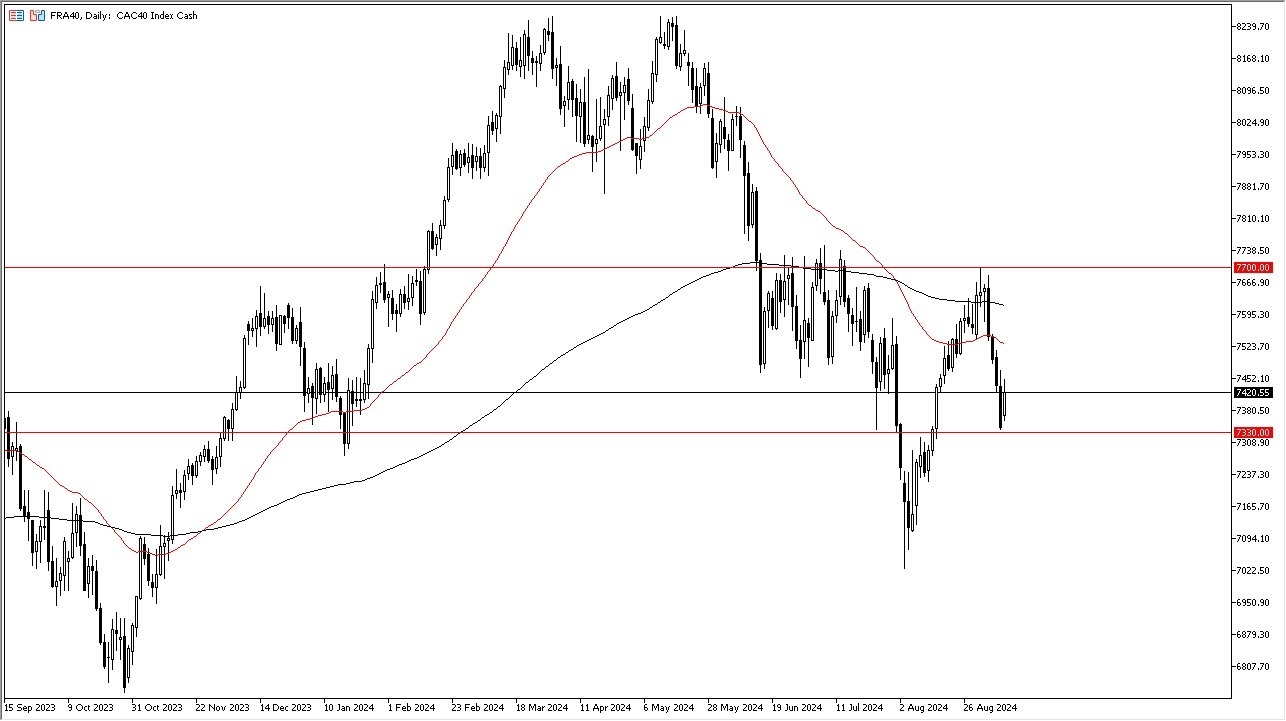

The €7330 level is an area that has been important multiple times, and it is worth noting that we have bounced from there. Because of this, I do think that we have found a short-term floor, and therefore I think it’s worth paying close attention to what happens next. The €7330 level being violated to the downside would be a very negative turn of events, and could send the Parisian CAC much lower, perhaps even sending most of the European indices down with it as it would all more likely than not be correlated.

Top Forex Brokers

On the other hand, if we can break above the €7450 level, then we might have a bit of a relief rally ahead of us. In that environment, we probably see the market go looking to the €7700 level, which is where the latest swing high was, and it is also an area where we have seen a lot of noise. Anything above there would obviously be very important, and it would probably bring a lot of money into the market to chase momentum to the upside.

All things being equal, I think this is a market that will more likely than not see a lot of resistance above, so it would not surprise me at all to see rallies get faded. Keep in mind that this is a major European index, so it does make a lot of sense to follow other ones at the same time, because it can give you a bit of a “heads up” as to where this is going.

Ready to trade our stock market analysis? Here’s a list of some of the best CFD trading brokers to check out.