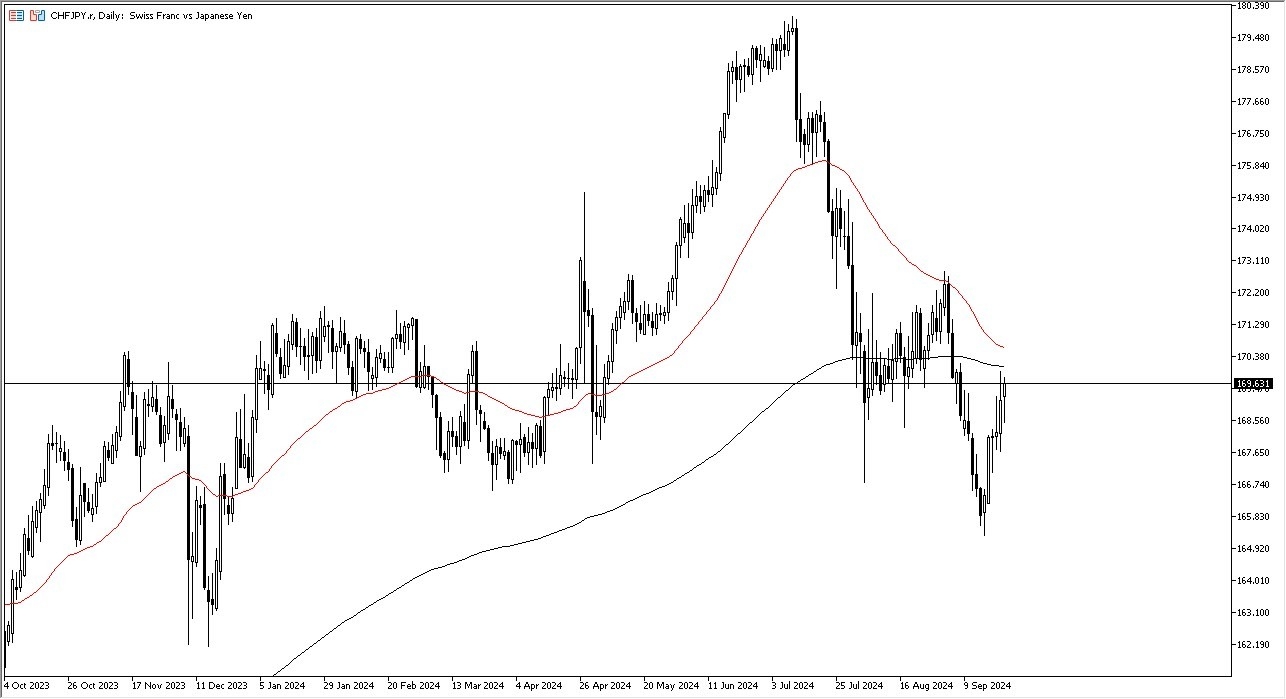

- During the trading session on Monday, the first thing I see when looking at the CHF/JPY pair, we have seen a complete turnaround from the initial selloff.

- This suggests to me that traders are paying close attention to the Japanese yen, and therefore I think you’ve got a scenario that the risk appetite of traders around the world will be a major issue.

- The 200 Day EMA above should offer a significant amount of resistance, especially considering that the ¥170 level is an area that I think a lot of people will be paying close attention to.

Technical Analysis

The technical analysis suggests that we are about to see a lot of resistance, because the 200 Day EMA and the 50 Day EMA both come into the picture, as well is a major cluster of selling pressure previously. As we head back into that area, there would be a lot of “market memory” coming into this scenario, as the volatility will almost certainly pick up. If we do manage to break through all of this area, essentially closing above the ¥172 level, then it’s likely that we will go much higher. This would more likely than not have a lot more to do with the Japanese yen then the Swiss franc, and it would probably kick off a new era of carry trade action in multiple pairs, not just this one.

Top Forex Brokers

If we turn around and break down below the ¥168.50 level, then the market could go down to ¥166 level. Regardless, this is a market that I think is worth paying attention to because it gives you an idea of how the carry trade will be funded, and that of course is a very important thing to know as far as going to the carry trade situation as it either returns, or it falls apart. Whichever one of these 2 currencies is currently dropping, that’s generally the one that I will shorten against higher yielding currencies when I get a technical set up in those pairs.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.