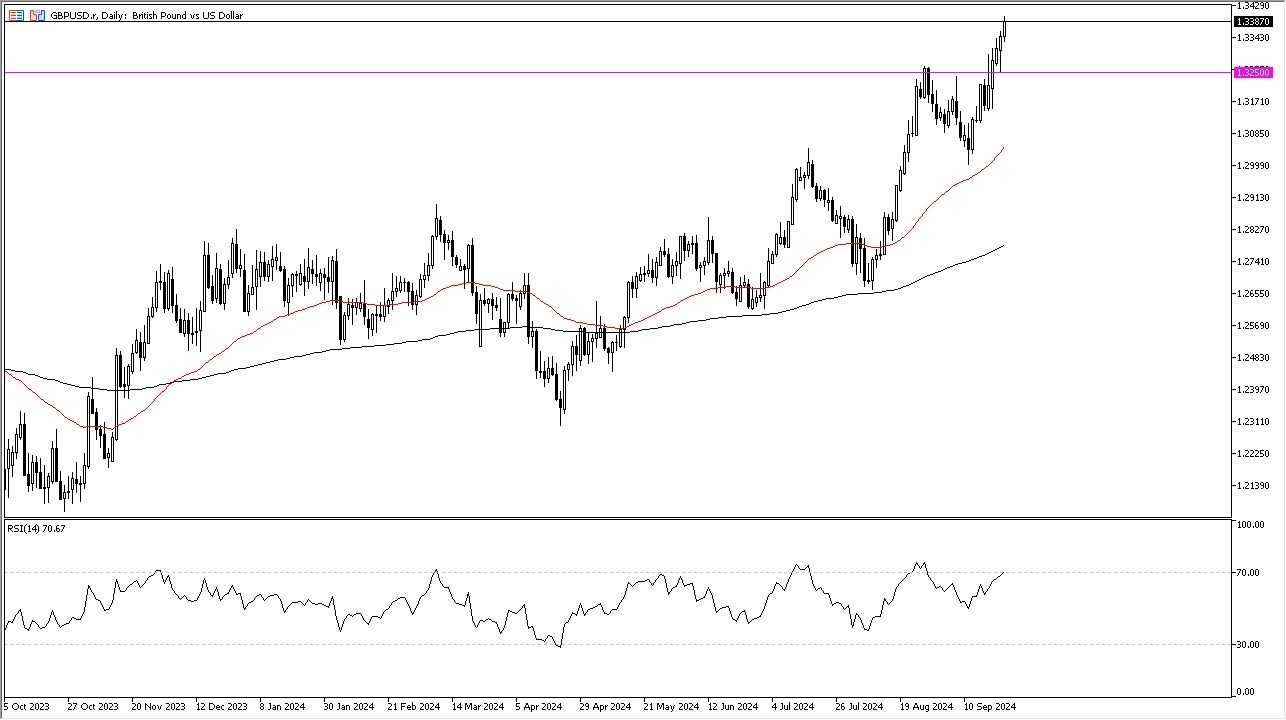

Potential Signal:

- I am a buyer of short-term pullbacks in this currency pair, especially near the 1.33 level.

- At this point, I would have a stop loss of 1.3225 and would be aiming for the 1.35 level.

The GBP/USD exchange rate has captured my attention due to the fact that we continue to go much higher, and therefore I think you got a situation where we are trying to reach toward the 1.35 level over the longer term. Recently, we have pulled back to the 1.3250 level, only to turn around and bounce again. This is a very strong sign for the British pound overall.

Top Forex Brokers

Bank of England and the Federal Reserve

The Bank of England recently has decided to standstill as far as its interest rate policy is concerned, and that makes it a situation where the British pound has been one of the big winners, due to the fact that it is one of the few major central banks around the world that keeps its interest rates fairly high, and the interest rate differential between the United States and the United Kingdom are wiped out. Because of this, it’s a situation where you don’t necessarily get paid one way or the other, so now it comes down to how the central banks are behaving.

The Federal Reserve

The Federal Reserve of course recently cut interest rates by 50 basis points, which is generally a sign that the economy is struggling. I understand that they suggested that they might be able to create what is known as a “soft landing”, but at the end of the day history shows that every time the Federal Reserve cuts by 50 basis points, something bad happened shortly thereafter.

If that is in fact going to be the case, the reality is that the US dollar might eventually strengthen due to some type of panic, and of course the United Kingdom is not operating in a vacuum, so if the United States falls, it almost certainly means that the United Kingdom will follow right along with it. However, this point in time it looks like short-term pullbacks will continue to be buying opportunities, and that’s exactly how I am playing this market.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.