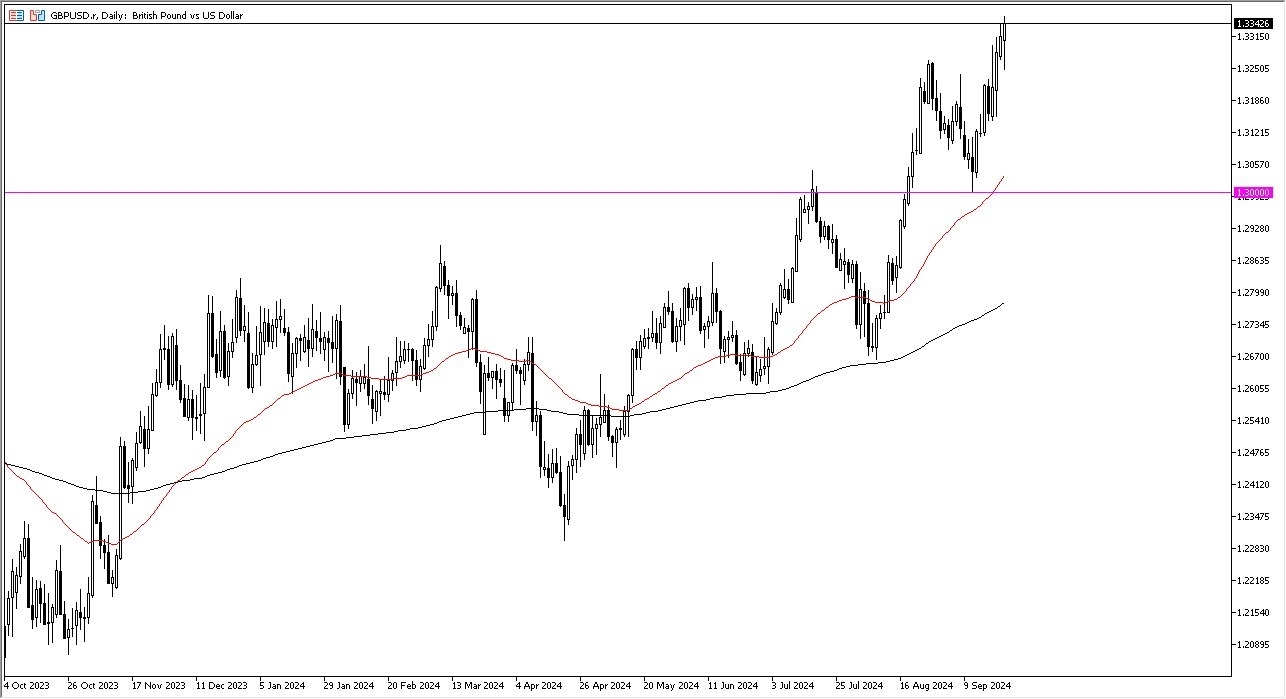

- The British pound initially pulled back a bit against the US dollar during the early hours on Monday, but you've seen traders come in and start buying the pound right at the 1.3250 region.

- Now as we look at this, it looks like the market is ready to continue going quite a bit higher.

- Ultimately, it looks like the 1.35 level above could be a bit of a target, when you look at longer term charts, short term pullbacks at this point in time continue to attract attention from everything I see.

It does make a certain amount of sense because Wall Street, specifically the Americans are celebrating the idea of a falling US dollar due to the Federal Reserve and cutting interest rates by 50 basis points last week.

Top Forex Brokers

Bank of England

The Bank of England on the other hand has not cut and therefore it shows that it has a bit more resiliency and I think that's something that must be kept in the back of your mind as well. In fact, the British pound might be one of the better performing currencies out of the G10 that I follow due to central bank policy being much more hawkish than many others. The market is dropping from here, but will find plenty of support at multiple spots, but I believe the 1.30 level is really the floor in the market at the moment. If we can break above the 1.35 level, then I do believe that the British pound continues to go higher, and I think it probably could happen. We are a little bit stretched at the moment, but the way we rebounded later in the day does suggest that there are still plenty of people willing to come in and pick up dips.

Ultimately, this is a market that looks very bullish, but that does not necessarily mean that the market is going to fall apart in the short term. In general, do believe that value hunters will continue to be one of the major drivers of this pair, as the central bank divergence will continue to capture a lot of attention.

Ready to trade our GBP/USD daily analysis and predictions? Here are the best forex trading platforms UK to choose from.