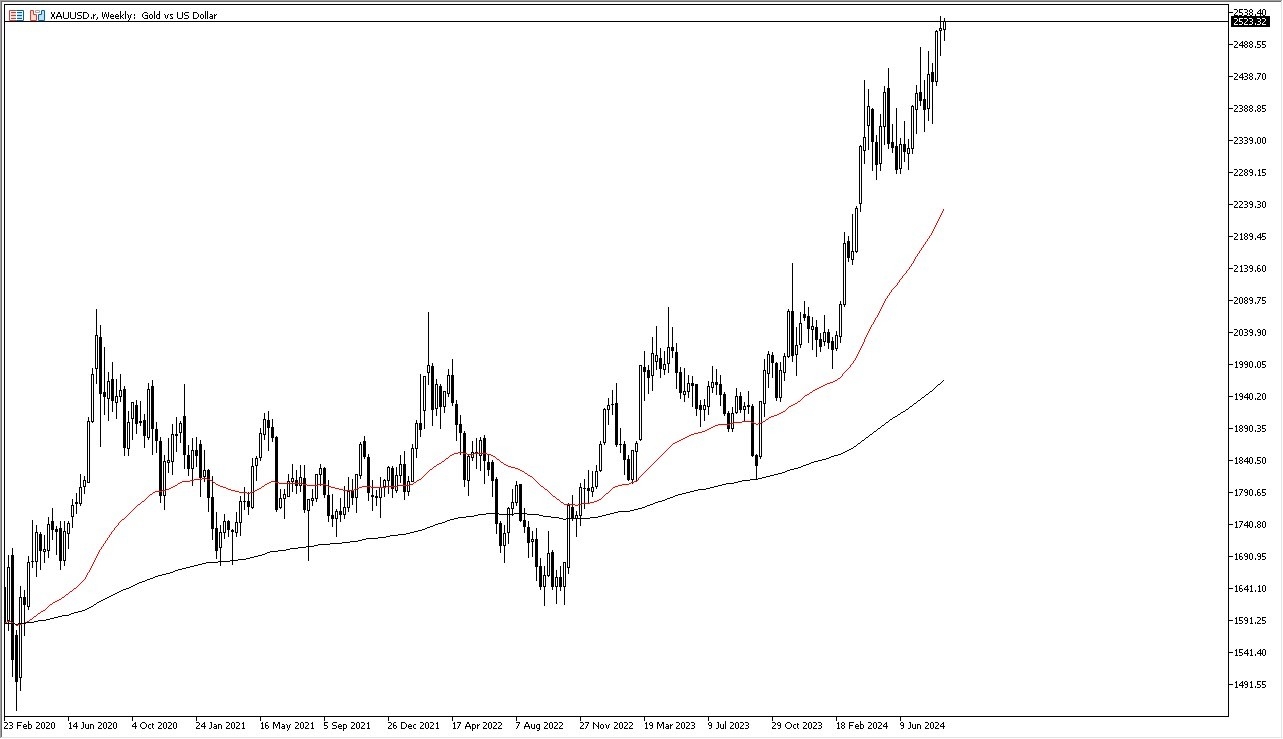

- Gold continues to be very positive, as the month of August has been very strong.

- At this point, we are a bit stretched but during the month of August, we have cleared the $2500 level, and it looks like we have much further to go.

- Ultimately, I do think that gold goes much higher, but I also recognize that there are going to be fits and starts along the way.

At the end of the day, the easiest way to describe the gold market is that it is a “buy on the dips” scenario, and there are a plethora of reasons to think that this will continue to be the case going forward. Because of this, I do think that we will eventually reach the $2600 level during the month of September, and perhaps even higher than that. However, it’s not to say that the market won’t have plenty of volatility, because quite frankly I think that’s probably something you can count on in not only the gold market, but probably almost every market on earth.

Top Forex Brokers

The central banks of India, Russia, and China are all piling into the gold markets, and therefore we automatically have a bit of a buyer of last resort in this scenario. Furthermore, we have the Federal Reserve likely cutting rates between now and the end of the year at least a couple of times, and that should continue to benefit gold as it will mean that bonds pay much less as far as a coupon is concerned. This negates some of the cost of storing gold, because unlike retail traders, it’s quite common for bigger institutions to actually buy physical gold.

Furthermore, we cannot forget about the massive amount of geopolitical risks that currently plague the marketplace. Quite frankly, it does not look like the conflict in the Middle East is going to slow down anytime soon, and there’s always the possibility that something flares up in the Ukraine war as well. In general, the world is a bit of a mess, so it does make a certain amount of sense that the gold market will continue to attract inflows.

Ready to trade our monthly forex forecast? Here’s a list of some of the best XAU/USD brokers to check out.