- The New Zealand dollar has rallied pretty significantly against the Canadian dollar during trading on Thursday as the crude oil market continues to drag the Canadian dollar down with it.

- In this particular currency pair, you do have two commodity currencies battling each other.

- But it's also worth noting that New Zealand is more about soft commodities - food products, if you will.

- Therefore, it might be considered to be just a little safer as far as commodity trading is concerned. After all, you can consume less oil, but sooner or later, your population has to eat.

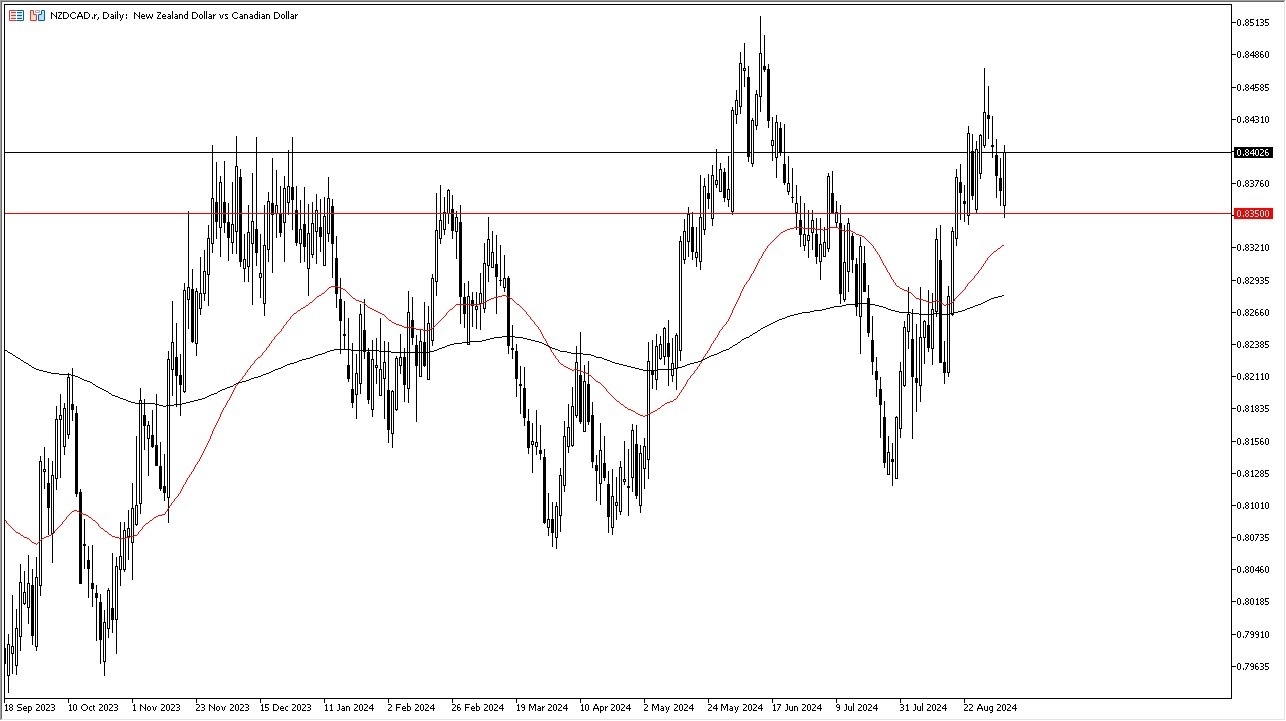

So, with that being said, there's always a little bit of demand for the New Zealand dollar anyway. Now that we look at this pair bouncing so significantly from the 0.8350 level, it does look like we're going to try to continue the overall uptrend. The 0.85 level above is a significant round figure. If we can break above that, then the market could really start to take off to the upside. Well, on the other hand, if the market were to break down below the 0.8350 level, then we start to look towards the 50 day EMA followed by the 200 day EMA indicators to offer some type of support.

Top Forex Brokers

The Market Will Remain Noisy

I do think this is a market that's probably going to be noisy, regardless of what it typically is. But with all of the momentum that we have seen recently against the Canadian dollar and against oil, I suspect that going higher from here probably makes more sense than not.

Ultimately, I think we’ve got a situation where the momentum itself will probably eventually cause some type a breakout, but we will have to wait and see whether or not the lack of strength in Asia spreads to New Zealand, because it was certainly has spread to Canada in the form of lower oil prices which of course cause major issues for the Canadian economy.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.