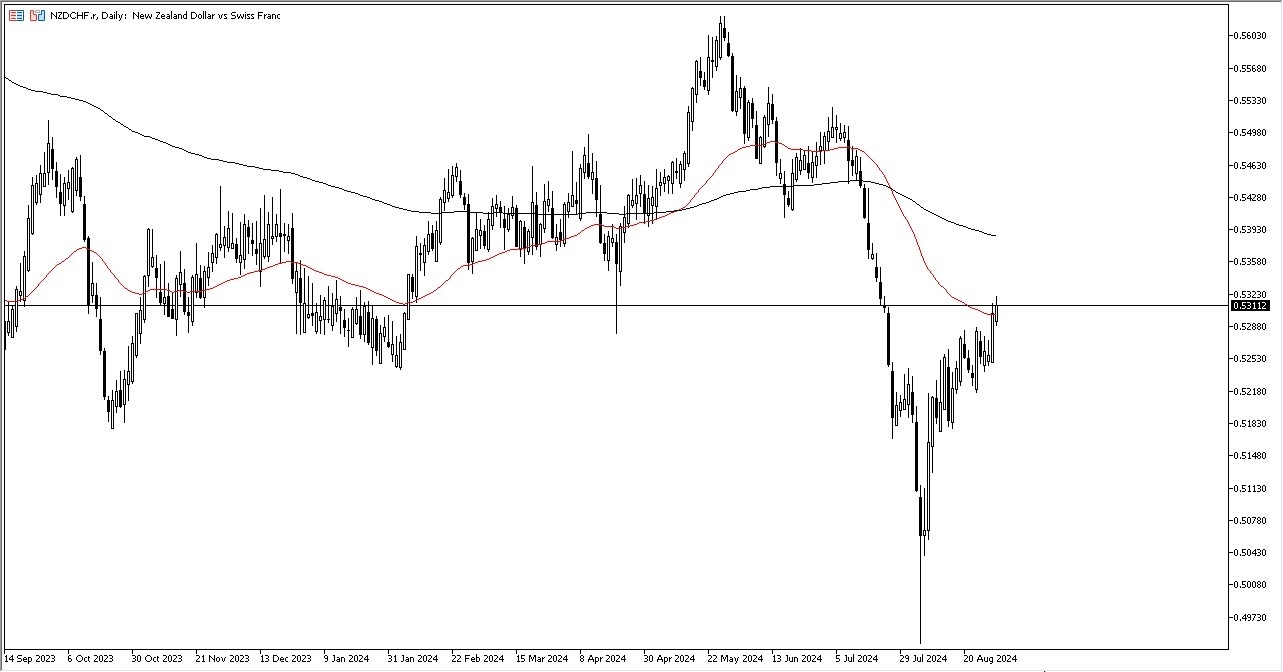

- As we have broken higher during the trading session on Friday, it looks like we are continuing to see the Swiss franc lose some of its strength.

- This is interesting considering that the carry trade with seemingly dead, but now we are trying to turn that thing around.

- All things being equal, this is a market that I think is very interesting to watch, due to the fact that the 2 currency pairs are so far apart on the spectrum that it gives you a good “heads up” as to where the markets are going in an overall sense.

Risk Appetite

It’s worth noting that the pair is highly sensitive to risk appetite, as the New Zealand dollar is obviously a commodity currency, and of course the Swiss franc is considered to be one of the ultimate “safety currencies in the world.” With this being said, the market breaking out to the upside in clearing the 50-Day EMA is a very bullish sign, and that does suggest that perhaps we have much further to go to the upside. Ultimately, as long as this pair continues to rally, I think that risk appetite in general will continue to be something worth paying attention to.

Top Forex Brokers

One of the other ways that you can gauge risk appetite is to see how stock markets are going, and if they are doing fairly well, then it means this pair should do fairly well given enough time. All things being equal, the market is likely to continue to see a lot of volatility, but after the very explosive move to the upside on Thursday, and the continuation on Friday, then it looks likely that we are going to continue to see buyers willing to step in. I believe at this point in time we also have a significant amount of support at the 0.52 level, so anything between here and there that shows a bit of a pullback in a bounce could be very attractive for traders. On the upside, I suspect that people are going to be aiming for at least the 0.54 level.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.