Potential signal:

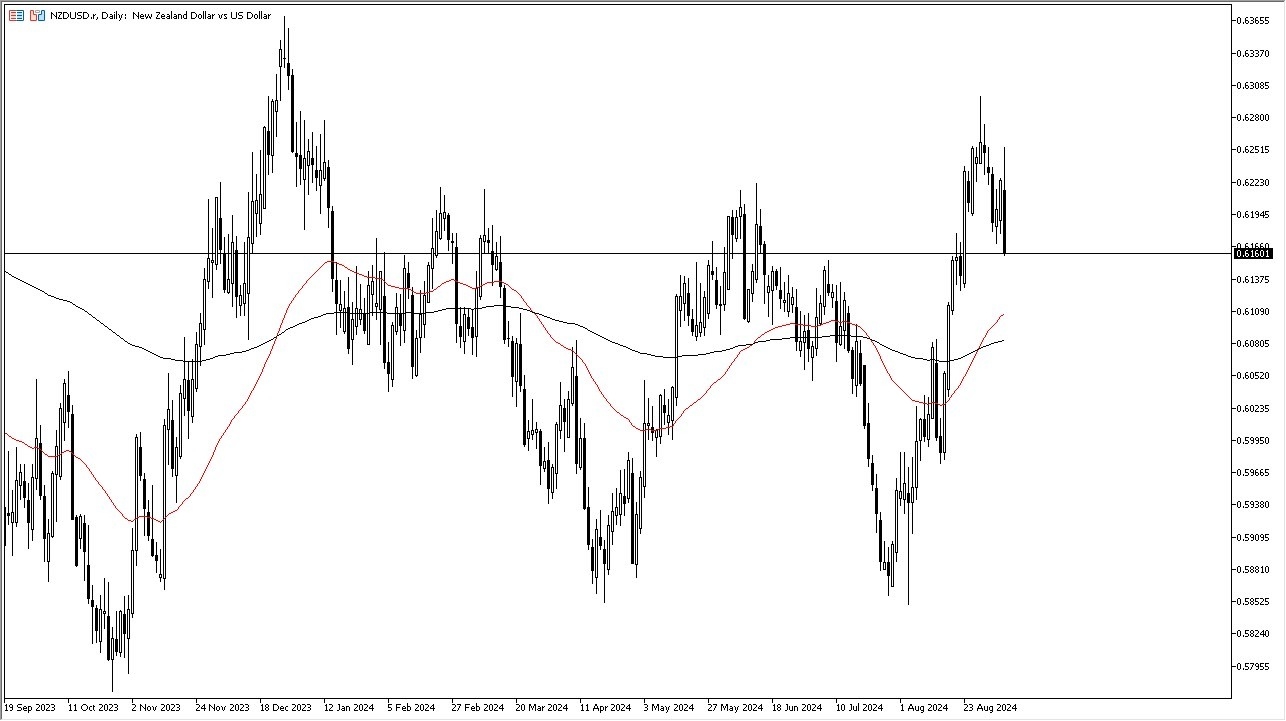

- I’m a seller of this pair if we can break down below the 0.6133 level.

- I would have a stop loss at the 0.62 level, and I would be aiming for a move down to the 0.6025 level.

- We initially tried to rally but after the jobs report became such a mess in the United States, we have seen a complete turnaround and the market falling apart.

- This makes a certain amount of sense considering that the New Zealand dollar is considered to be a “risk on currency”, as it is also a commodity currency.

- In an environment where we have seen so much negativity, I think it’s probably only a matter of time before this pair pulls back.

Top Forex Brokers

Technical Analysis

It’s probably worth noting that the 0.63 level is an area that has been a major resistance barrier, and the fact that we have pulled back from there suggest that we had gotten a little bit overdone. If we can break down below here, the 0.6150 level could be broken, and then after that we could go looking to the 0.6133 level, which is the next minor support level. After that, then we have the 50 Day EMA offering support near the 0.61 level.

All things being equal, this is a very negative candlestick, and these massive candlesticks typically do not operate in a vacuum. In other words, I think it’s probably only a matter of time before we see the downward pressure continue in the NZD/USD currency pair, as the US dollar will attract a lot of inflow, despite the fact that the jobs number is so bad. While this is somewhat counterintuitive, the reality is that people will be looking to the treasury markets in order to protect wealth, which of course uses US dollars in order to facilitate trade.

At this point, I don’t think there’s any real shot at this pair being strong, and I think this could set up a potential selling opportunity for a somewhat big move. While the Federal Reserve is likely to cut rates, it also shows that perhaps things are getting somewhat dicey out there, and it makes sense that people are starting to move to safety assets such as the greenback.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.