Signals for the Lira Against the US Dollar Today

- Risk 0.50%.

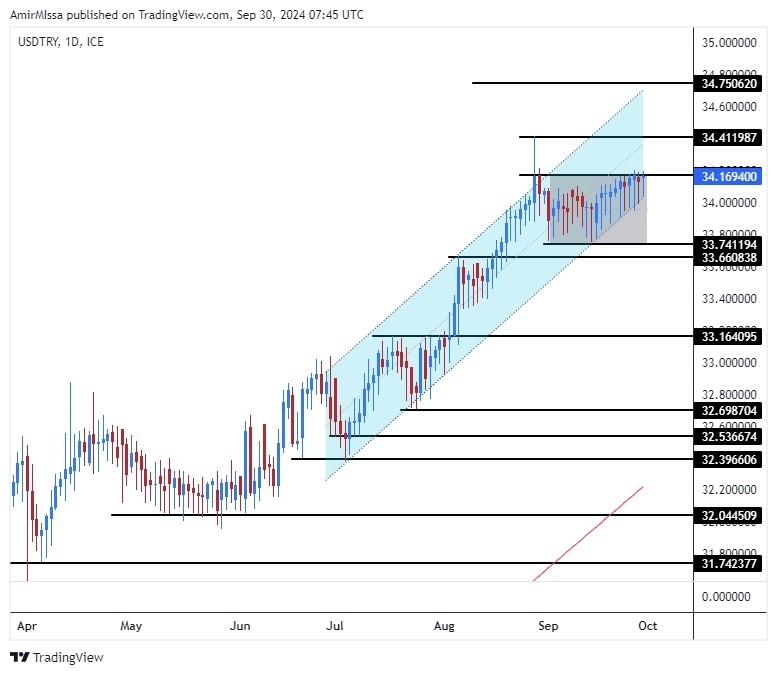

Bullish Entry Points:

- Open a buy order at 33.90.

- Set a stop-loss order below 33.75.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.15.

Bearish Entry Points:

- Place a sell order for 34.16.

- Set a stop-loss order at or above 34.35.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.80.

The dollar price against the Turkish lira stabilized without significant changes. The pair has varied in a limited trading range over the past four weeks, and the lira is heading to record a monthly close with limited declines recorded at the beginning of this month. Reports indicate that the Turkish Central Bank is supporting the stability of the Turkish currency at current levels while ensuring that the lira does not decline so that inflation does not rise, using the large foreign exchange reserves that have increased significantly during the current month.

The Turkish Central Bank revealed that the bank's reserves recorded a record high level as of September 20, according to statements by Turkish Finance Minister Mehmet Simsek. The bank's reserves amounted to $156.4 billion, up by about $2.8 billion from the last update. Foreign exchange reserves rose to $94.1 billion, while gold reserves reached $62.3 billion. The Turkish minister attributed this increase to the stability of the economic situation in his country.

In terms of data, the Turkish Statistical Institute announced the economic confidence index data for September. The index, which was at 93.1 points last month, rose by 2% to 95 in September. In the same period, the consumer confidence index rose by 2.4% to 78.2 points, and the real sector confidence index rose by 1.2% to 99.2%.

In other data released at the end of last week, reports revealed that Turkish exports recorded about 22 billion 48 million dollars in August. Meanwhile, imports recorded 27 billion 40 million dollars. Also, the external trade deficit reached 4 billion 992 million dollars. Ultimately, the ratio of exports to imports rose to 81.5%.

Top Forex Brokers

TRYUSD Technical Analysis and Expectations Today:

The US dollar pair against the Turkish lira (USD/TRY) did not witness any changes at the beginning of the weekly trading. The price maintained its movements in a sideways range within the rectangle pattern shown in the chart. On a larger time frame, it is clear that it is moving near the lower limit of the ascending price channel on the daily time frame, which is the channel that supports the dollar's rise. Despite the current divergence, the general trend prevailing on the pair is still bullish, with the pair trading above the 50-moving average on the four-hour time frame. If the pair rises, it targets the levels of 34.20 and 34.50, respectively. On the other hand, if the pair declines, it targets the levels of 33.90 and 33.70 liras, respectively. Technically, the Turkish lira price forecast includes divergence as long as it stabilizes within the range of the rectangle shown. While on a larger time frame, every decline in the dollar price represents an opportunity to buy back.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out