- In my daily analysis of the Australian dollar against the Japanese yen, the market has seen a bit of a selloff previously, only to turn around and show signs of life.

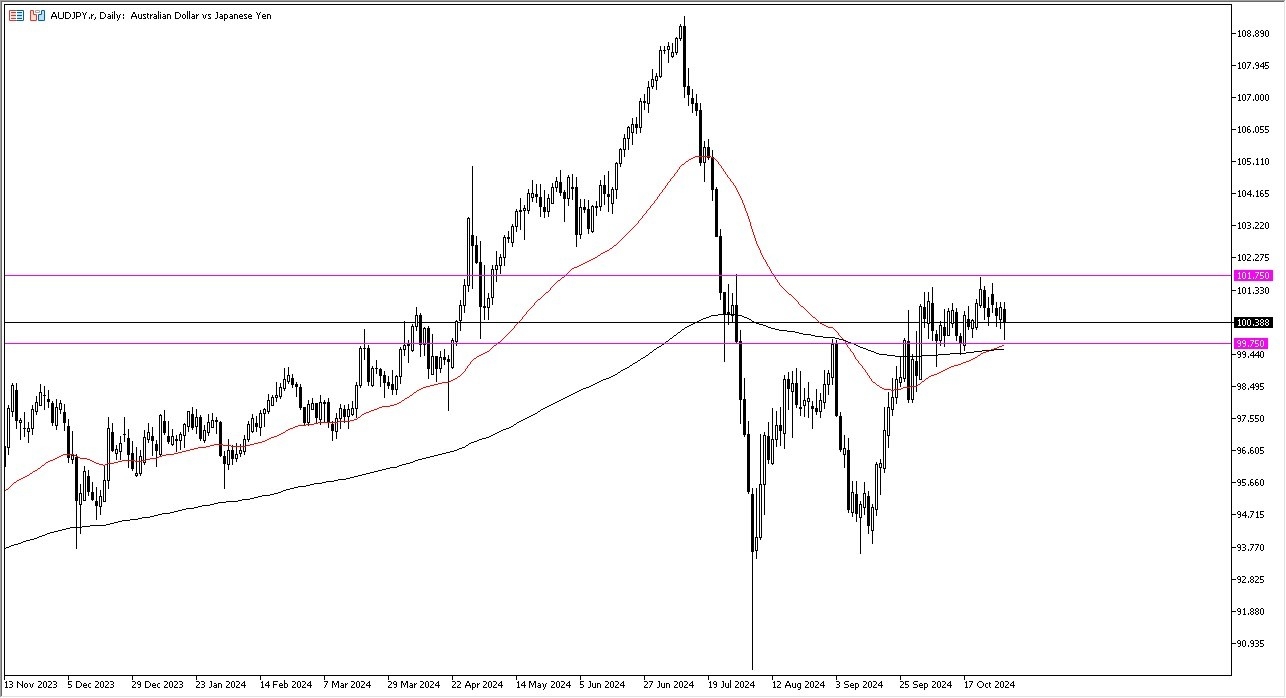

- All things being equal, this is a market that has seen a lot of support near the ¥99.75 level, which has not only been important multiple times in the past, but also has a certain amount of technical support due to the fact that we have the 50 Day EMA and the 200 Day EMA indicators in that spot.

This is a market that has been stuck between 2 major levels, with the ¥99.75 level being the floor, and the ¥101.75 level above being the ceiling. Keep in mind this market had rallied quite nicely ahead of this, so the fact that we are going sideways should not be a huge surprise. After all, we have the Bank of Japan come out and basically say and do nothing, so now we are waiting for the Non-Farm Payroll announcement on Friday, the reality is that the volatility in the markets will quite often be drastic on the day, despite the fact that you may not be dealing with the US dollar directly.

Top Forex Brokers

Risk Appetite

Keep in mind that this is a pair that is very sensitive to risk appetite, as the Australian dollar is considered to be a “risk on currency.” That being said, the market is likely to continue to see a lot of traders looking at whether or not the global economy is going to continue to strengthen, or if we are going to see some type of faltering when it comes to the global risk appetite, and therefore it favors the Japanese yen as it is considered to be a “safety currency.”

I do favor the upside, but we had shot straight up in the air previously, so this sideways action that we have seen over the last couple of weeks makes a lot of sense, and I think is just simply a matter of “working off the froth.”

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.