Potential Signal:

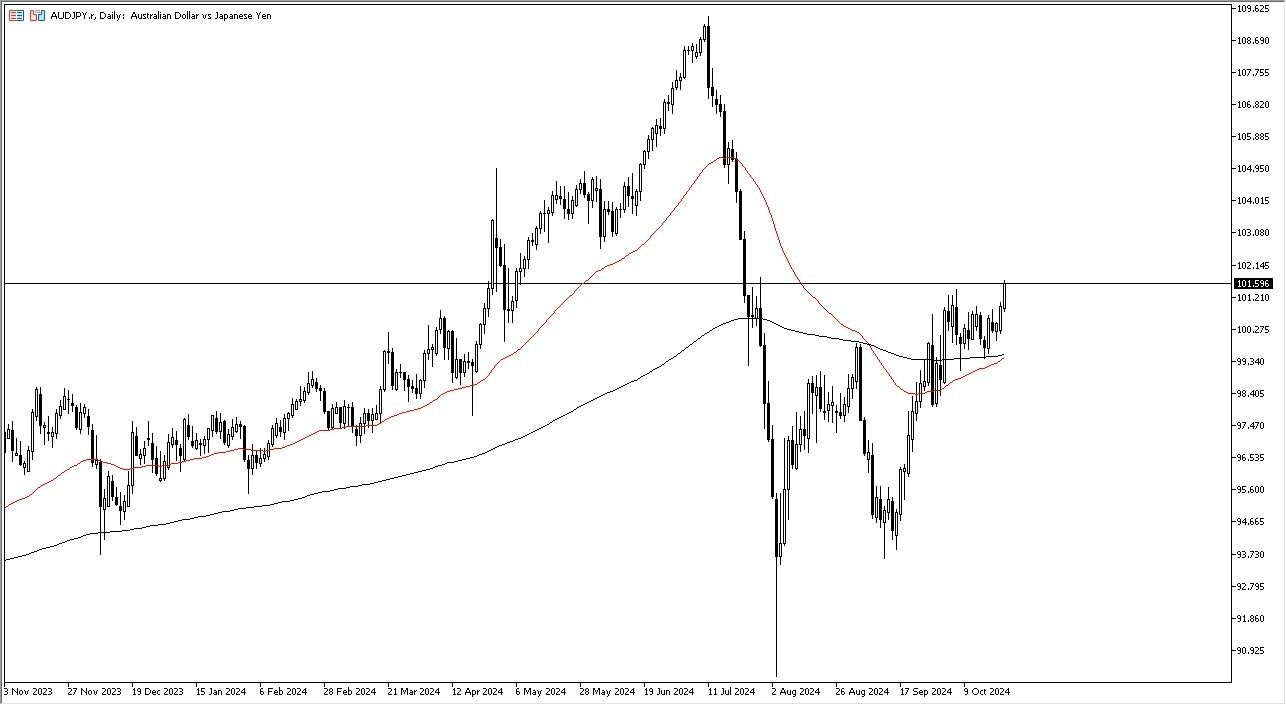

I am a buyer of this pair at the ¥102 level. I would put a stop loss at the ¥101 level, with a target at the ¥104.25 level.

- In my daily analysis of the JPY-related pairs, the AUD/JPY pair has caught my attention as it is a pair that is highly sensitive to risk appetite, and of course the Bank of Japan itself.

- Recently, we have seen the Bank of Japan throw up its hands and suggest that he cannot do anything about tighten monetary policy, and this has been one of the places you have seen the reaction to that.

- Given enough time, I do think that we continue to go much higher, and it looks as if the market is in the process of trying to break out going forward.

Short-term pullbacks should continue to be buying opportunities, and I do think that we have a lot of support underneath that not only due to the fact that we have so much momentum, but we also have the 50 Day EMA starting to cross above the 200 Day EMA as well, kicking off the so-called “golden cross.” I also recognize that there is a lot of noise out there when it comes to risk appetite, so I don’t necessarily think that it’s going to be the easiest thing to deal with in this pair, but quite frankly you get paid at the end of every day to hold onto the Australian dollar against the Japanese yen, and I think that continues to be a major factor.

Top Forex Brokers

Technical Analysis

The technical analysis of course is very bullish, but I think if we break above the ¥102 level, then this pair truly starts to take off. The 50 Day EMA breaking above the 200 Day EMA of course is a very bullish sign, but I do find that you can get the occasional “fake out” when using it as a signal. All things being equal, you do get paid at the end of every day, and that is probably the most important thing to pay attention to.

All things being equal, it’s not until we break down below the ¥98 level that I would consider shorting this pair, and quite frankly we would need to see a lot of ugly action to make that happen, something that seems very unlikely at this point. Because of this, I remain bullish, and I believe that a trade is setting up.

Ready to trade our AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.