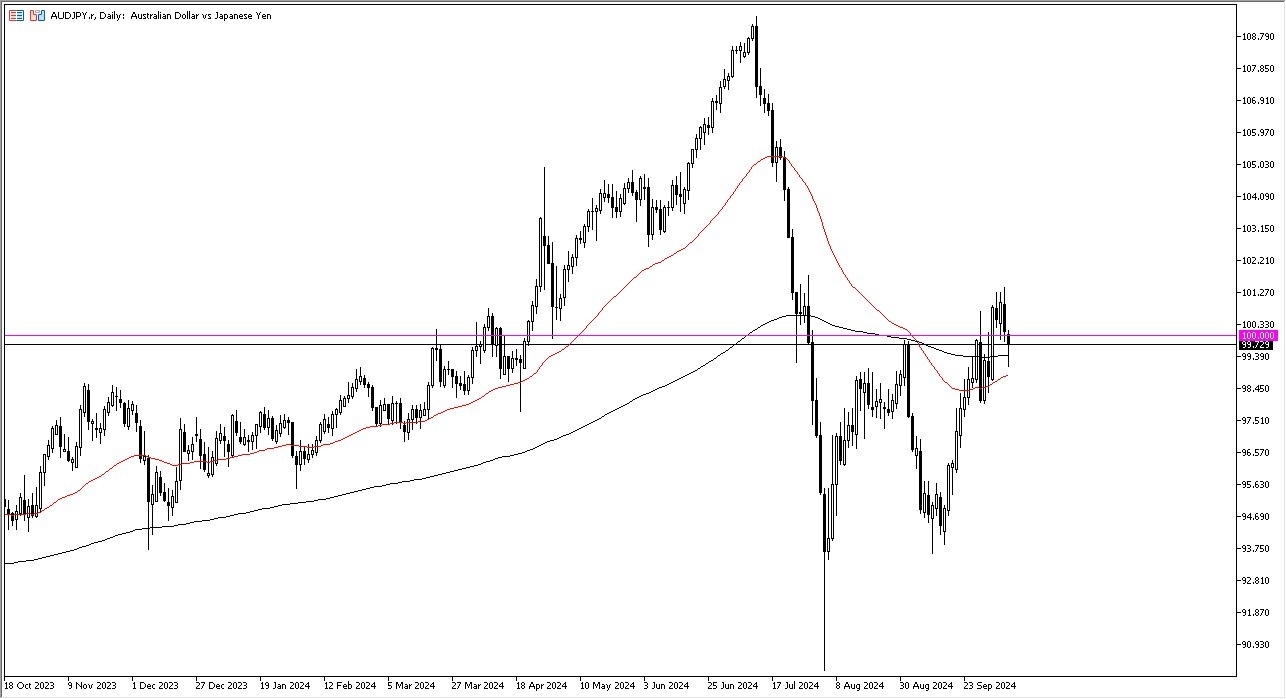

- The market had recently broken out, and now it looks like it is trying to confirm that breakout.

- Furthermore, we also have a situation where the market is closer to the ¥100 level, and that of course has a certain amount of influence on how people pay close attention to this market.

Furthermore, the 200 Day EMA has shown itself to be supportive, and then after that we have the 50 Day EMA indicator offering support also. As I read the chart, it looks as if we are going to do everything, we can to form a hammer. The hammer of course is a very supportive looking candlestick, and if we can break above the top of it, and other words break above the ¥100 level on a daily close, it’s likely that this market could go much higher.

Top Forex Brokers

Carry trade

Keep in mind that the carry trade is still very much intact, as interest rate differential continues to favor the Australian dollar. Furthermore, you also have to keep in mind that the Bank of Japan has recently had an interest rate decision and press conference where they had essentially suggested that there was no real way to tighten monetary policy from this point on. Because of this, the interest rate differential continues to favor Australia, and probably will for the foreseeable future.

The RBA doesn’t look like it’s ready to cut rates anytime soon, but even if it did, there is a huge differential between Australia and Japan, so I think you’ve got a situation where the carry trade will be one of the main drivers of this market, as people get paid at the end of every session to hold on to this currency pair. It’s not until we break down below the ¥97.50 level that I would consider shorting this pair, and even then, I would be a bit hesitant to. On the upside, if we break above the ¥101.50 level, the Australian dollar could very well go looking to the ¥105 level.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.