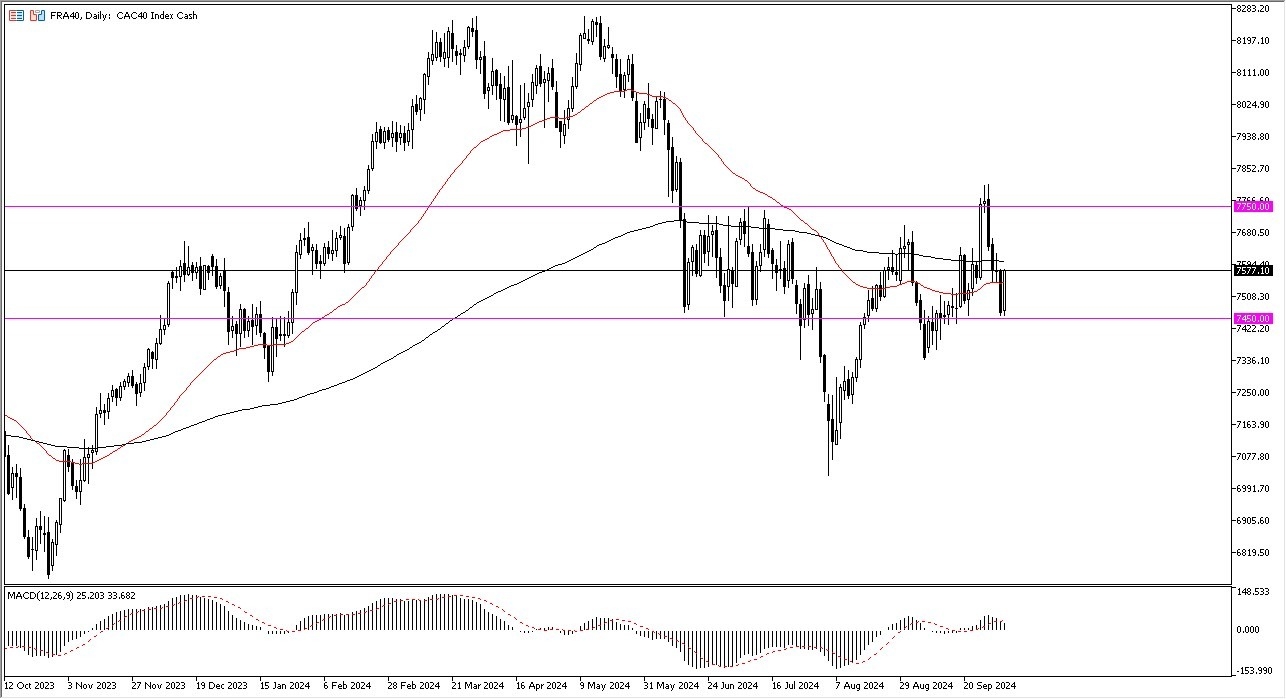

- The most obvious thing is that we have seen a turnaround in most indices, and the CAC 40 in Paris of course is no different.

- In fact, we have completely recovered all of the losses from the Thursday session and have shown the €7450 level to be as significant support.

- All things being equal, this is a market that continues to see a lot of noisy behavior, but ultimately, we are sitting in the middle of a massive consolidation area.

With all that being said, the market is likely to continue to be very noisy, but I think it will end up being a scenario where a lot of people will continue to look at the idea of the US economy strengthening perhaps bleeding over into other ones, thereby driving at the idea of exports in France doing better. That being said, this is a market that is also considered to be one of the biggest in Europe, so it’s one of the first places money goes to in order to get back to work.

Top Forex Brokers

Technical Analysis

The technical analysis for this index at the moment suggests that we are in fact going to stay somewhat elevated, and perhaps hang around the overall consolidation region between the aforementioned €7450 level, and the €7775 level above. Ultimately, this is a market that I think continues to be very noisy, but it also will take its cues from the DAX in Germany, as it does end up playing 2nd fiddle to the Germans quite often.

It’s worth noting that the 50 Day EMA and the 200 Day EMA indicators both are going sideways at the moment, so this shows real indecision as well. I think ultimately this is a market that is going to continue to be a bit erratic, but I do think that it’s easier to buy this market and it is to start selling it, because quite frankly indices tend to be very upside driven anyway. The size of the candlestick is worth noting, and it’s particularly telling that we completely wiped out that negative Thursday session.

Ready to trade the daily forex analysis? Here are the best CFD brokers to choose from.