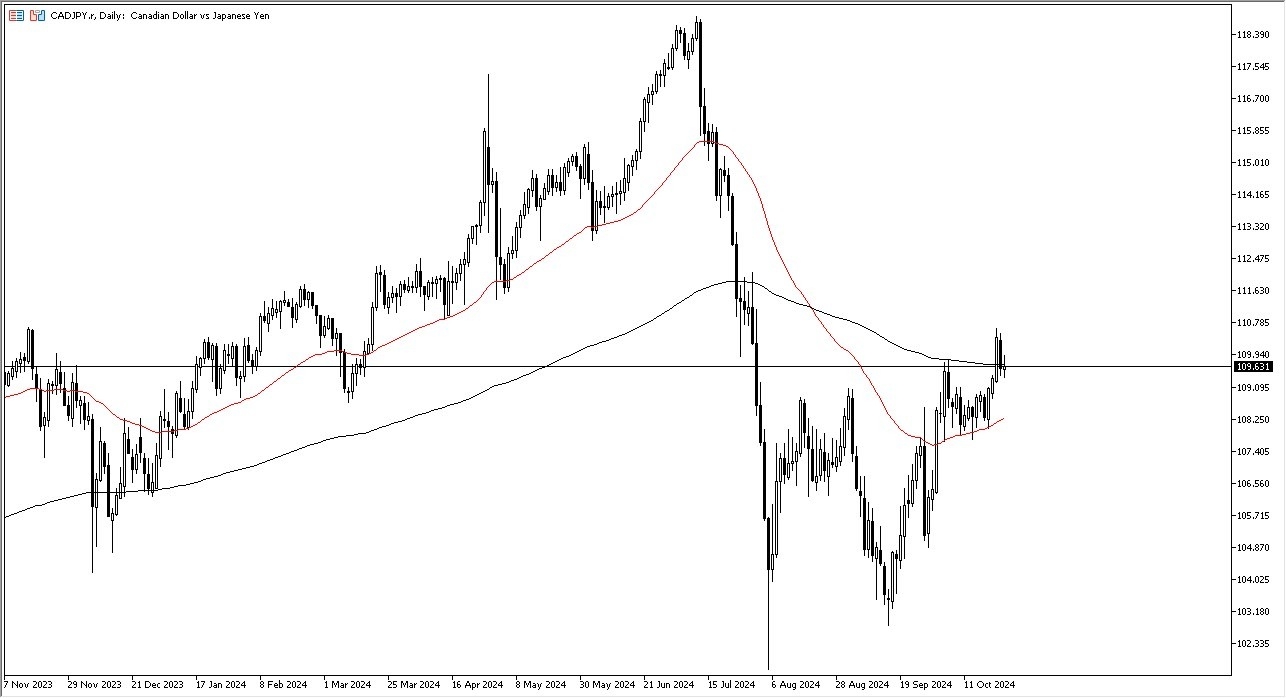

- During the trading session on Friday, it's been a little back and forth in this pair as we continue to hang around the crucial 200-day EMA.

- I suspect this is a scenario where we are just killing some time as we headed into the weekend as we are trying to figure out whether or not we can continue to see upward momentum.

- This is an indicator that a lot of people pay attention to determine the overall trend and as we have broken well above it a couple of days ago, pulled back to test it and on Friday just kind of hung around.

- I think you've got a situation where we are trying to confirm the breakout to the upside.

Remember the interest rate differential continues to favor the upside, and I think that's the one thing that you really need to pay attention to mainly due to the fact that we have so much in the way of interest rate differential come into the picture as the carry trade gets hot again. While the Bank of Canada has recently cut rates, the reality is that the Bank of Japan simply cannot do anything to tighten monetary policy, and therefore you're seeing the Japanese yen struggle against most currencies, not just Canada. If oil starts to take off, then you could see a major move to the upside as the Canadian dollar is a proxy for crude oil, and at the same time, the Japanese economy imports 100% of its crude oil, so it makes sense that it would go higher.

Top Forex Brokers

Short Term Dips

In general, I think we've got a situation where short-term dips offer value, and even if we did break down from here, you can see the 50-day EMA near the 108.25 yen level offer a bit of a floor. In general, I do think that we are going to try to work our way towards the 112 yen level, and then eventually the 115 yen level, but with the Bank of Canada cutting rates a couple of times already, this might be a little slower than some of the other yen related pairs.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.