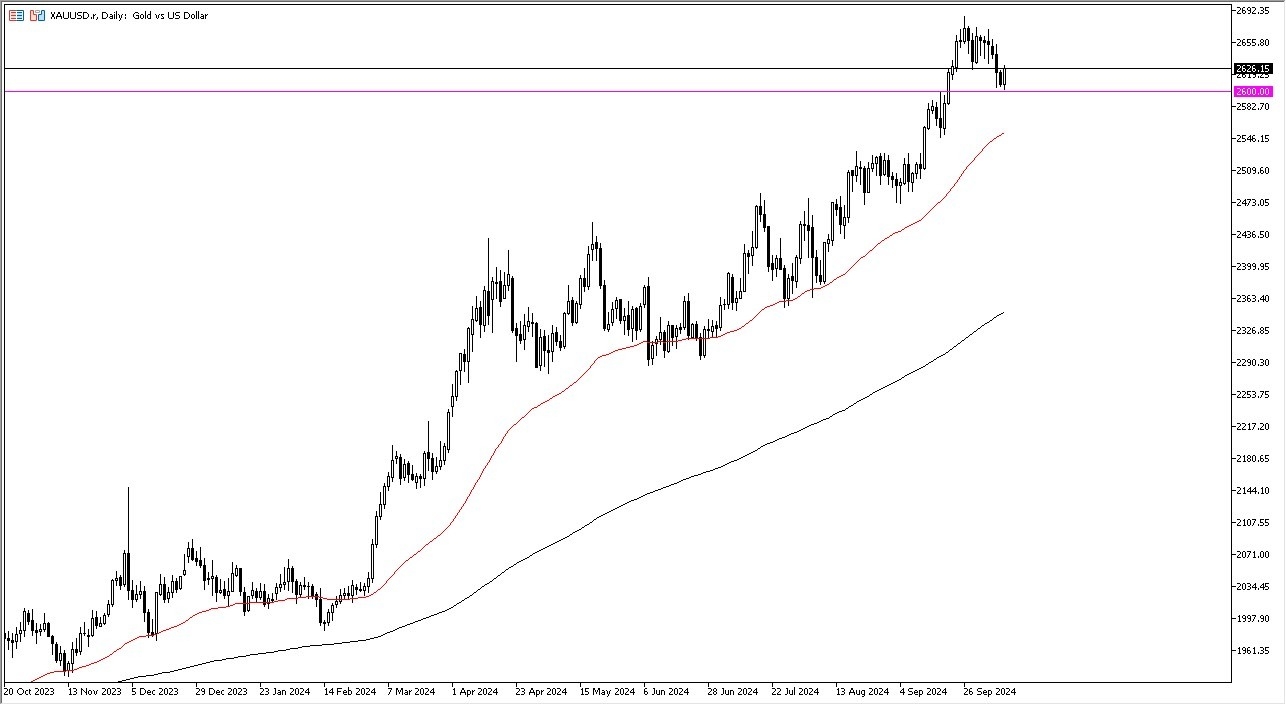

- During my daily analysis of the gold market, I continue to look at the upward trajectory as being important, and the market pulling back to the $2600 level is being met by quite a few buyers.

- All things being equal, the market is likely to continue to go looking to the $2675 level.

Technical Analysis

The technical analysis for this pair is very bullish, as we have seen the market pull back just a bit to reach the $2600 level, an area that has been important multiple times. By bouncing the way we have during the trading session on Thursday, it suggests that we are going to continue to go higher. All things being equal, this is a market that I think will try to reach recent highs, near the $2690 level. If we can break above there, then it opens up a move to the $2700 level, and then eventually the $3000 level.

If we break down below the $2600 level, then it’s likely that the market could go looking to the 50 Day EMA underneath, near the $2550 level. This is an area that we have seen support in the past, so I think it’s probably only a matter of time before we see buyers jump in and try to defend that area. Regardless, I just don’t have any interest in shorting this chart as it looks so strong, and I think it will continue to be the case.

Top Forex Brokers

There are plenty of reasons to think that gold will continue to go higher, not the least of which of course is going to be the fact that central banks around the world continue to buy gold, with such heavy hitters as Russia and China joining the fray. All things being equal, this is a market that I think continues to go looking to the upside not only due to central banks, but we also have to keep in mind that there are a lot of central banks around the world cutting rates, so that also provides a little bit of momentum for the gold market.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.