Potential Signal:

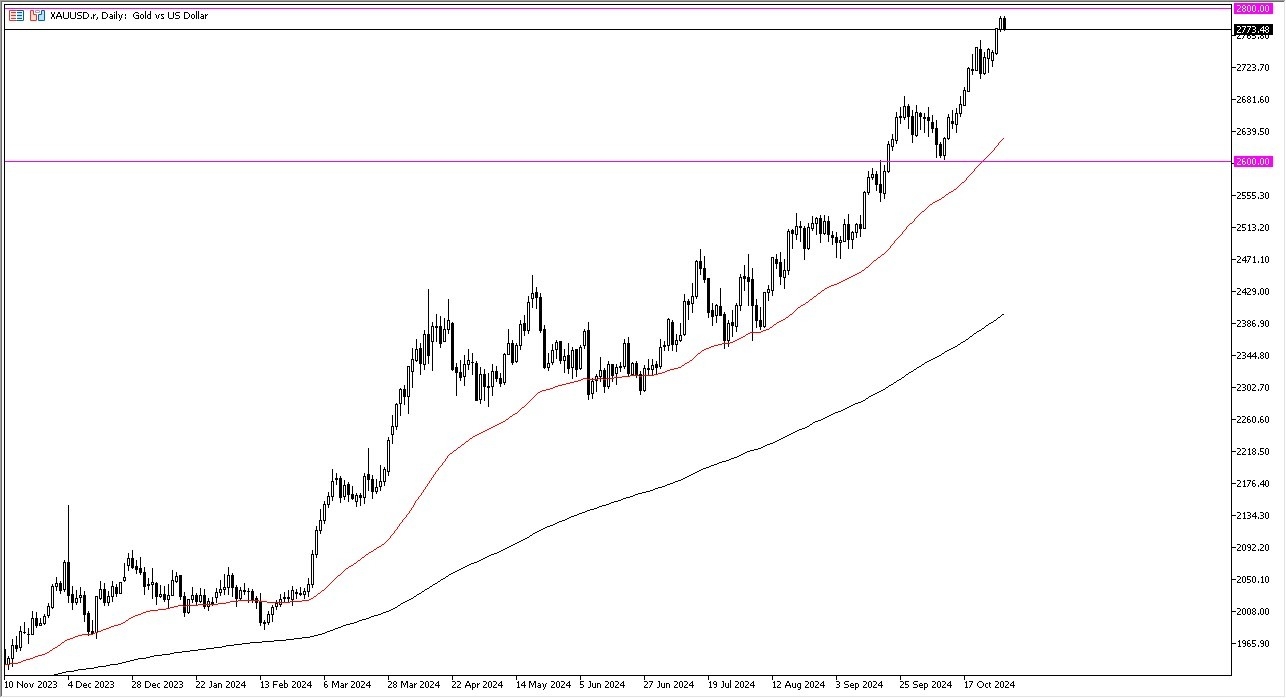

- I’m a bullish trader when it comes to gold markets, and if we do in fact continue to fall from here, I am more than willing to buy gold near the $2750 level on a dip.

- I would have a stop loss near the $2730 level and would be aiming for a move to the $2800 level above.

In my daily analysis of the gold market, the first thing I see is that we are in fact starting a pullback. This does make a certain amount of sense, considering that we had gotten a little bit ahead of ourselves over the last week or so. Furthermore, I think you also have to keep in mind that the Non-Farm Payroll announcement coming out on Friday will obviously have a major influence, so I think we need to look at it through that prism.

On a pullback at this point in time, I do think that the $2700 level will end up offering a certain amount of support, as it has been previously things being equal, this is a situation where traders have been very bullish for some time, and perhaps some people are looking to bank some of the profit that they have ended up with. With this being the case, the market is likely to continue to offer more of the “buy on the dips” type of opportunities for traders willing to get long of the gold market eventually.

Top Forex Brokers

Technical Analysis

The technical analysis of this pair obviously is very bullish, but the fact that the $2800 level has offered significant resistance, is something that you have to pay close attention to due to the fact that it is a large, round, psychologically significant figure. Furthermore, there’s probably a certain number of options being traded in that area that people will be watching.

All of this being said, the 50 Day EMA currently sits right around the $2630 level and rising, and therefore we are likely to see that offer a bit of a “floor in the market” if we do in fact start to fall that far. I think if we break above the $2800 level, then the market is likely to go looking to the $3000 level over the longer term, which I do think that we will eventually reach given enough time.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.