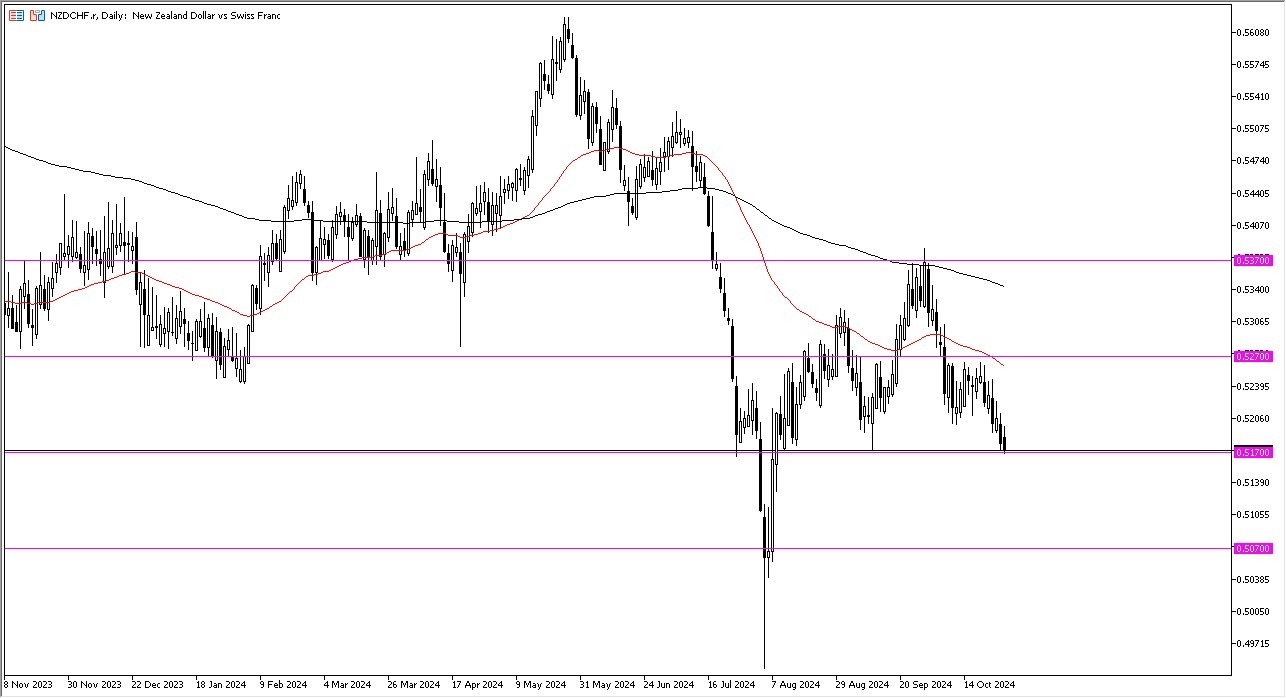

- Early in the session on Monday, the New Zealand dollar did try to rally against the Swiss franc, but it gave back those gains rather rapidly.

- I am now watching the 0.5170 level very closely because it has offered a bit of a floor in this market.

- That being said, if we break down below there, then I think you probably see the Swiss franc strengthen a bit against multiple currencies because that was generally what was happening in the beginning of the session anyways.

This would be especially true with weaker risk on type of currencies like the New Zealand dollar. After all, we've seen the Kiwi dollar just get absolutely hammered out of late and I just don't see how that changes anytime soon.

Top Forex Brokers

Riks Appetite and this Market

The desire to buy riskier assets around the world is drying up, and that means the Kiwi dollar isn't as appealing as a safety asset like the Swiss franc. On the other hand, if we were to turn around and break above the 0.5250 level, then we have to ask questions of the 50-day EMA. If we can get above that, then technically speaking, a return to the 200-day EMA would be somewhat anticipated.

If we were to break down at this point though, then the 0.5070 level is my next target. Anything below that level gets a little dicey because sooner or later the Swiss National Bank probably gets involved. Although I should say that when they get involved, it won't be directly through this pair. It will probably be through the Euro against the Swiss franc and the US dollar against the Swiss franc. But this pair will move in sympathy with what's going on in those markets. This is a minor pair to say the least, but there are a lot of other markets out there that come into the picture when thinking about buying or selling this currency pair.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.