- I’ve noticed that the New Zealand dollar has fallen pretty significantly during the trading session on Friday.

- All things being equal, this is a market that I think continues to see a lot of noisy behavior, as the New Zealand dollar is highly sensitive to the overall risk appetite around the world, as the New Zealand dollar is highly sensitive to the commodity markets, as it is an agricultural export behemoth.

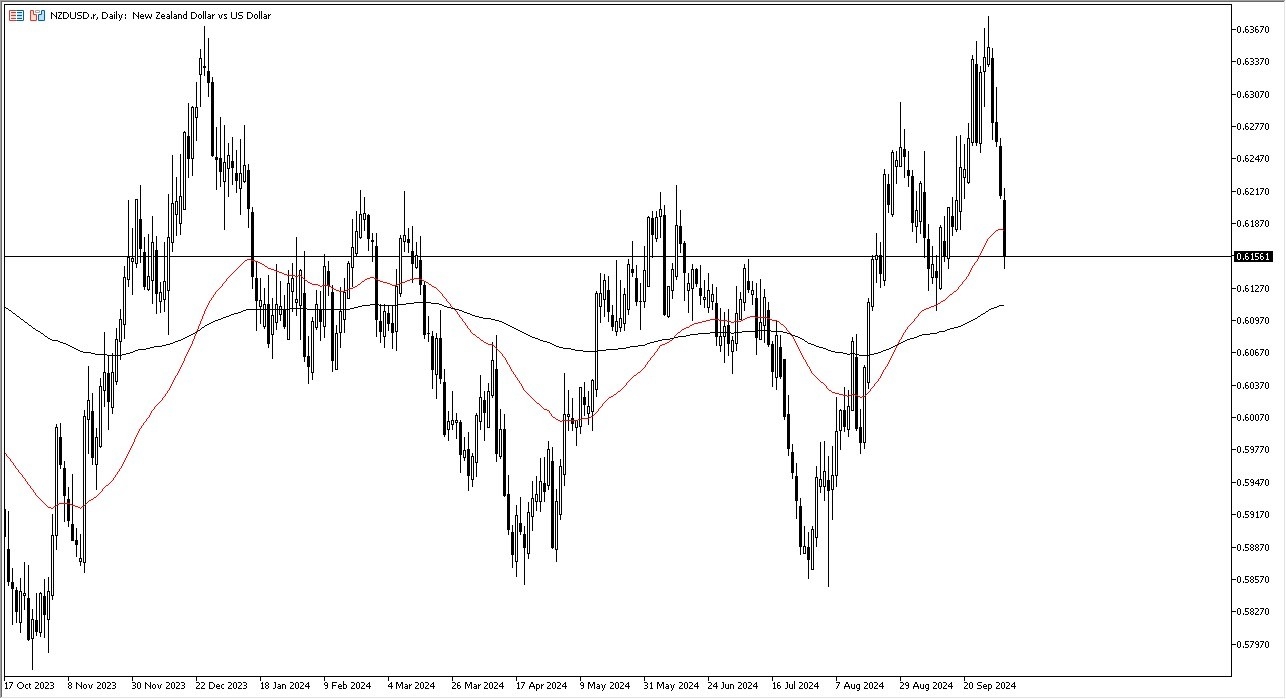

The New Zealand dollar of course is highly sensitive to the Asian markets as well, as it makes more sense for this pair to move right along with the idea of what’s going on in China, Indonesia, Malaysia, etc. With this being the case, the market is likely to continue to see a lot of volatility, but at this point in time you could also say that we are forming the “3 black crows” pattern over the last couple of days, which is typically a very negative sign.

Top Forex Brokers

Technical Analysis

The technical analysis is interesting for the NZD/USD pair, due to the fact that we just diced through the 50 Day EMA, an indicator that a lot of people will pay close attention to. A bounce from here could open up the possibility of a move back to the upside, but if we continue to see negativity, the 200 Day EMA will come into the picture for support near the 0.61 level. I think all things being equal, this is a market that will continue to be noisy, but it is going to only be a matter of time before we see a certain amount of support come into the market.

The rapidity of the selloff does suggest that there are a lot of concerns out there, and on Friday we have seen the Non-Farm Payroll announcement come out hotter than anticipated, as the United States economy continues to run very hot, and therefore think you got a situation where it’ll be interesting to see how this continues to influence the greenback itself.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.