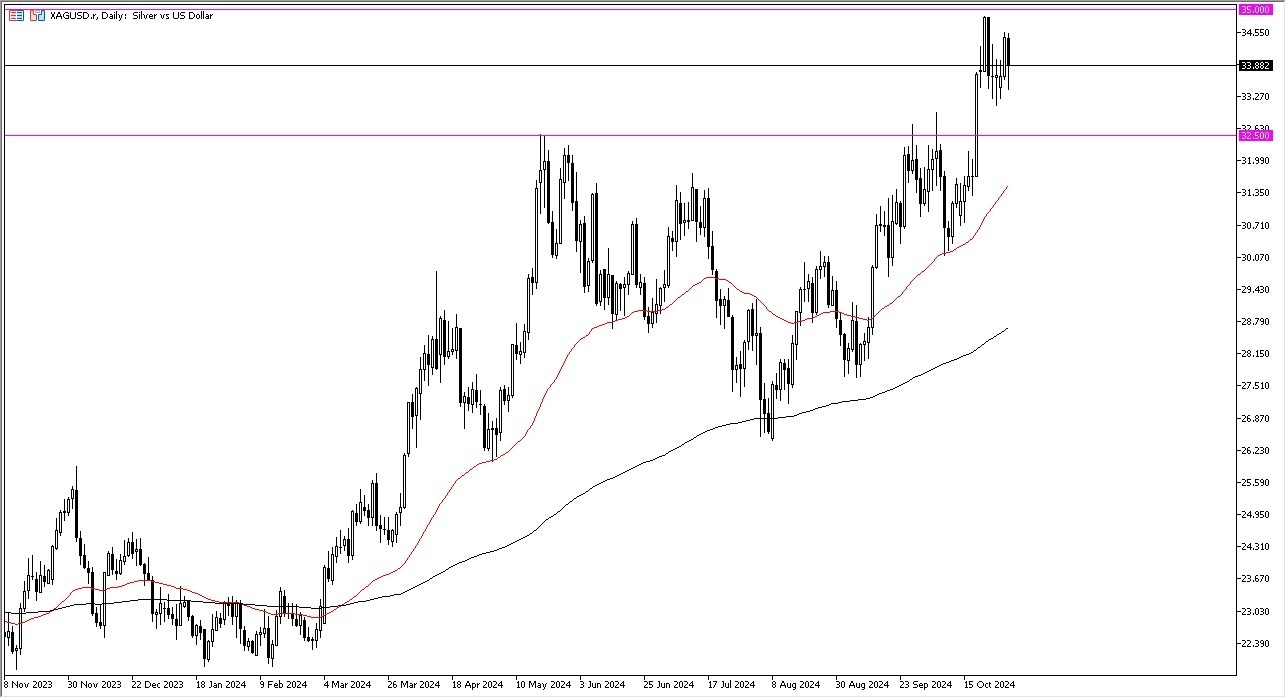

- As you can see, the silver market has plummeted during the early hours on Wednesday, only to turn around and show signs of life.

- All things being equal, this is a market that I think continues to see a lot of volatility, but that's nothing new for silver.

- After all, silver is a big contract, and it has a lot of external pressures on it in both directions that cause it to be a wild ride.

- Keep in mind that the size of the contract being bigger, of course, does mean that it can be much more dangerous if you are not careful.

So, keep in mind that this is a situation where the market is looking for a lot of back and forth between the $32.50 level underneath as support and the $35 level above as resistance. And I think this is going to be the battlefield here over the next couple of days, at least, as we have the jobs number coming out on Friday, and that of course will have a major influence on the US dollar.

Top Forex Brokers

Watching the US Dollar Gong Forward

Speaking of the US dollar, it's worth noting that it does have a sizable influence on the silver market, as does the interest rate market in America, which obviously will be moving after that job announcement as well. As long as we can stay above the $32.50 level, I believe this is a market that is still inherently bullish and will eventually try to break above the $35 level.

Anything above the $35 level could really get this market moving, but right now, as things stand, I think we are just killing time trying to work off some of the excess froth from the shot straight up in the air that we had over the previous couple of weeks. Silver has been bullish. I think silver will remain bullish, but the key here is to not get over levered so that you can hang on and wait for it to make its move.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.