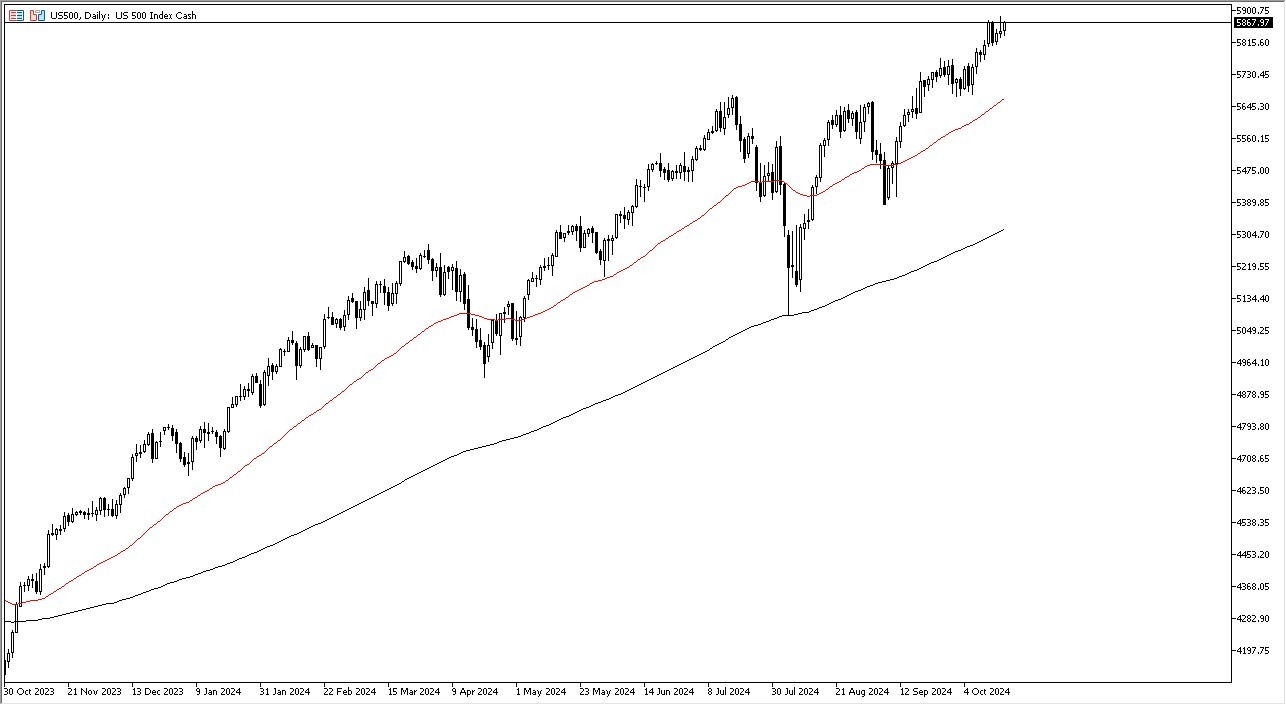

- The S&P 500 initially dipped slightly during the trading session on Friday, only to turn around and show signs of life.

- All things being equal, the market looks as if the 5,800 level is an area where traders are looking at it as a floor.

Given enough time, I fully anticipate that the S&P 500 will go looking to the 6,000 level. It's probably already more or less an expectation. It is worth noting that the Thursday candlestick was a nasty shooting star, and it's already being threatened the very next day. The 50-day EMA is all the way down at the roughly 5,700 level and rising, so I think that comes into the picture assuming that we even get that low.

Top Forex Brokers

The market is continuing to price in the idea of liquidity coming out of the Federal Reserve. And now you're starting to read bits and pieces about Wall Street, perhaps trying to price in a Donald Trump victory in the presidential election. I haven’t read too much into that yet, but you will start to see more and more of these stories depending on how the polls go, as to what type of leadership coming out of DC we will get. Clearly, Donald Trump is thought of as being more business friendly than Kamala Harris. With that being said, there are also influences coming out of the Senate race, which might flip over to Republican as well, and the House of Representatives, which is more or less a toss-up.

Divided Government? Maybe.

Ironically, Wall Street does tend to like divided government, so a full clean sweep by Republicans or Democrats, for that matter, would probably actually end up being very bad for the stock market. The idea, of course, is if you have divided government, not as much gets done and therefore they can't do as much to harm the economy. We are in a massive uptrend in that hasn't changed by any stretch of the imagination, so I think you still continue to look at the S&P 500 as a potential buy-on-the-dip scenario. With that, I remain bullish, but I do recognize that we are a little stretched at the moment.

Ready to trade the daily stock market analysis? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.