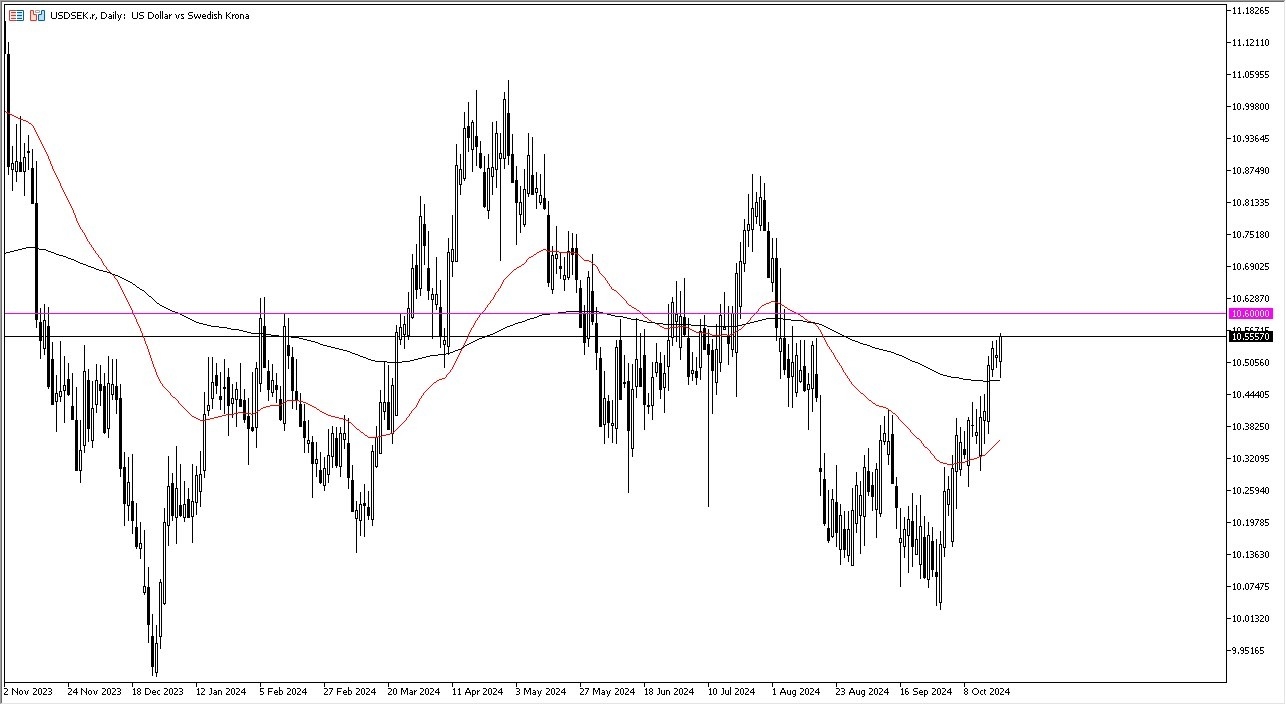

- In my daily analysis of exotic currency pairs, the USD/SEK pair looks interesting as we have rallied rather significantly, after initially dipping in the early hours of Monday.

- It’s worth noting that the 200 Day EMA has offered support, as it is an important technical signal. Furthermore, it also looks like the 10.50 SEK level has been important, so I think all things being equal, this is a market that is trying to build up enough momentum to continue going higher.

The 10.60 SEK level is a massive area of importance in both directions, and therefore I think we’ve got a situation where if we can break above there, it will stoke the flames of “FOMO trading” even more at this point in time.

The 10.60 SEK level is a massive area of importance in both directions, and therefore I think we’ve got a situation where if we can break above there, it will stoke the flames of “FOMO trading” even more at this point in time.

Ultimately, this is a market that could go looking to the 10.75 SEK level.

Top Forex Brokers

On the other hand, if we turn around a break down below the 200 Day EMA, then it’s likely that we could go down to the 10.40 SEK level, which is basically where we had seen a couple of swing highs in the past, and therefore I think a certain amount of “market memory” comes into the picture in that general vicinity. Even if we break down below there, the market could go looking to the 50 Day EMA, closer to the 10.35 SEK level.

Momentum

Everything in the market right now is all about momentum, and I think that will continue to be the case.

All things being equal, the US dollar is considered to be a safety currency, and of course the Swedish krona isn’t necessarily a risky as currency out there but is further out on the risk appetite spectrum than the US dollar is by far. All things being equal, I also think that this is a situation where markets are just simply all leaning in the same direction.

For what it is worth, the 10 year note reached 4.6% in the United States during the trading session, so that of course means that it’s much more attractive to own the dollar that it is the Krona at the moment.

Ultimately, it looks like the greenback is trying to swallow everything yet again.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.