- Speculators willing to trade in WTI Crude Oil must remain aware that noise from the Middle East conflict is still being heard.

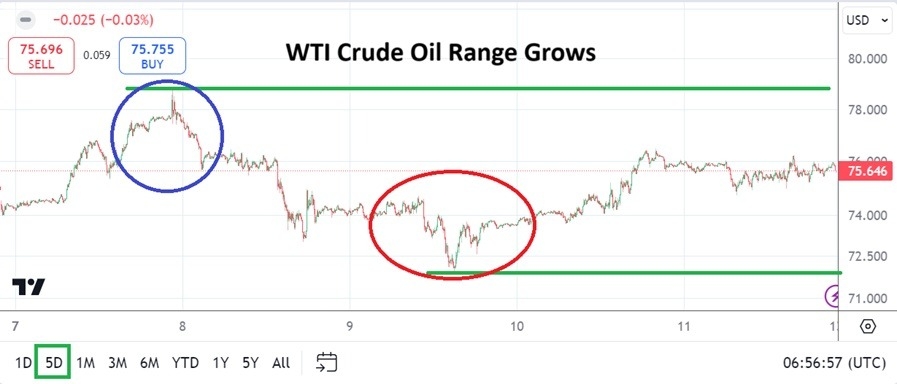

- The price of the commodity saw a rather wide price range emerge this week, having touched a high of nearly 78.800 on late Monday and then touching a low around 71.800 on Wednesday.

- WTI Crude Oil finished trading for the week near the 75.645 mark.

However, it was not only Middle East saber rattling that kept traders in WTI Crude Oil nervous last week, Hurricane Milton which hit the Gulf of Mexico and then walloped Florida was a factor too. Supply and demand remain a vital part of WTI Crude Oil trading, but anxiousness via the combination of Middle East rants and U.S weather certainly helped create the rather wide price realms seen last week.

WTI Crude Oil Middle Ground

The value of WTI Crude Oil found a rather comfortable technical middle ground going into the weekend. Perhaps large players in the commodity believed 75.650 thereabouts, presented a good resting place to now wait on developments from the Middle East and information regarding production capacity in the Gulf of Mexico. Tomorrow’s opening in Crude Oil will tell traders a lot about immediate sentiment.

The rather high finish to the week, however was well below the highs seen last Monday, and the low that was seen nearly two days later demonstrates that supply remains firm and confident. Day traders need to decide on what the behavioral sentiment of the big speculators in WTI Crude Oil will be in the coming days. No one knows. And the reason why no one knows is because everyone is waiting on what will happen in the Middle East. Meaning that experienced traders will likely remain calm until there are reasons given regarding why they should not be.

Wagering on Fast Downside Could be a Road Too Far

While the low seen in WTI Crude Oil touched on Wednesday represented the ability of the commodity to flirt with intriguing technical support, the commodity certainly held its ground. It appears for the time being durable support in the short-term may be 74.000 USD. Traders who are thinking about being sellers based on the notion larger speculators will remain calm and the lower price realm of WTI Crude Oil will develop rapidly, maybe getting ahead of themselves. There are reasons to suspect nervousness in the underlying tone of WTI Crude Oil remains.

Top Forex Brokers

- While it is possible developments from the Middle East will remain tame starting this week, there is a chance they may not.

- If news does get ominous the question then becomes one of potential escalation, compared to a limited conflict.

- Traders who have patience and the ability to hold onto positions may be inclined to believe the greater likelihood is that WTI Crude Oil prices may have reasons to rise in the coming days based on geopolitical concerns.

- Traders who make any decisions on WTI Crude Oil need to understand they are wagering in what will likely become a volatile marketplace.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 73.700 to 81.900

WTI Crude Oil trading will not be for the weak of heart this coming week. News developments while not always factual from the media, will none the less be trumpeted and this will affect the price of the commodity. The ability of large traders to remain calm was displayed when they kept the value of WTI Crude Oil within the middle of its weekly range.

The price of the WTI Crude Oil would likely be lower if the Middle East conflict was not creating constant noise. Day traders courageous enough to wager on WTI Crude Oil in the coming days need to practice risk management and remain alert for potential alarms. The highs seen early last week could be tested again promptly if saber rattling turns violent.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Oil trading brokers to choose from.