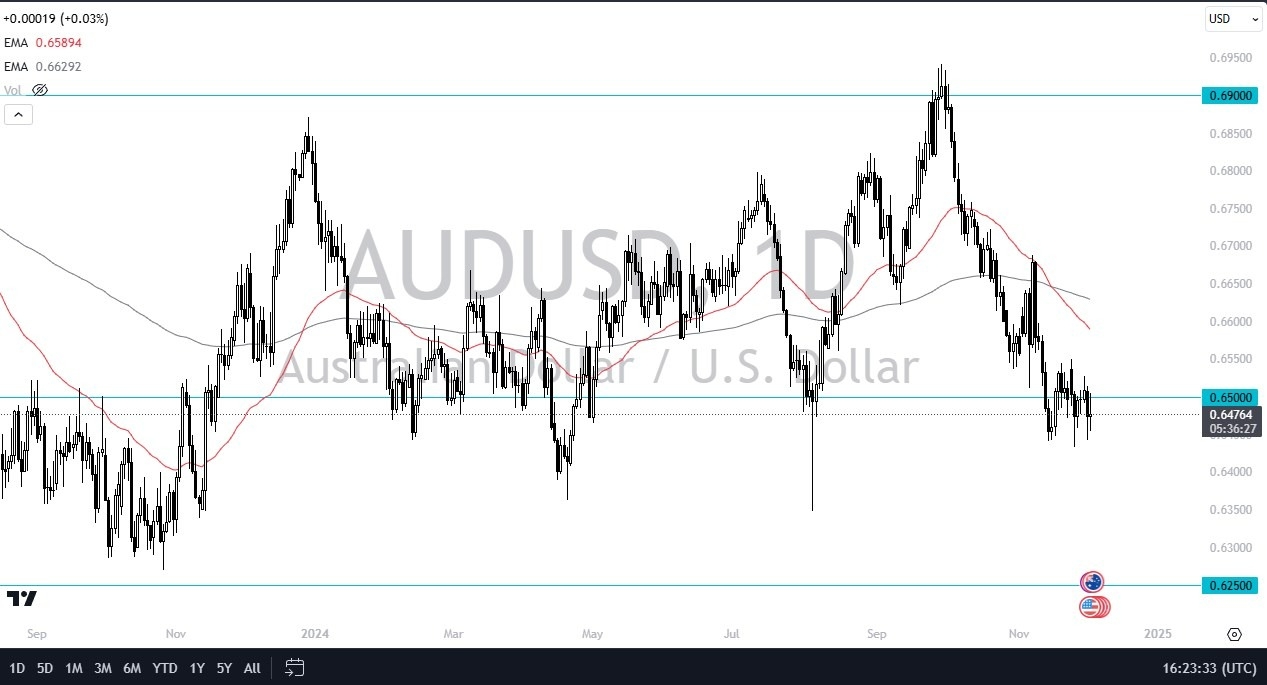

- The Aussie dollar initially broke above the 1.09 level during the early hours on Friday but has turned around quite significantly.

- With that being said, the market giving back the gains at the 200 day EMA makes a certain amount of sense, but really at this point in time, I think you've got a situation where traders are just simply trying to find their footing.

- In general, this is a market that is more likely than not going to see a lot of choppiness and questions asked of it, but really at this point in time, the market participants will continue to look at the area between the 1.09 level and the 1.0750 level as consolidation.

Risk Appetite Will Matter Here

Top Forex Brokers

With this being said, this is a market that is heavily driven by risk appetite. And of course, it's worth noting that the Australian dollar is heavily influenced by Asia and of course, global trade. If people are worried about global trade slowing down, that will not be a good thing for the Aussie. Add in the potential for trouble in Chinese economic conditions, this could be a problem.

That being said, the technical setup does look like if we can break above the 1.09 level on a daily close, then that could get the buyers jumping in. But the way this is behaving on Friday, I think we've seen a complete repudiation of that. The question now is whether or not we can drop down below the 1.0750 level, because if we did, that would probably be horrifically negative for the Aussie and risk appetite in general. Perhaps what we are seeing here is a lot of traders in the world right now not sure what to do with the greenback a couple of days ahead of the massive elections coming on Tuesday. This of course will continue to see a lot of influence, at least in the short term in this market.

Ready to trade our AUD/USD daily analysis and predictions? Check out the largest forex brokers in Australia worth using.