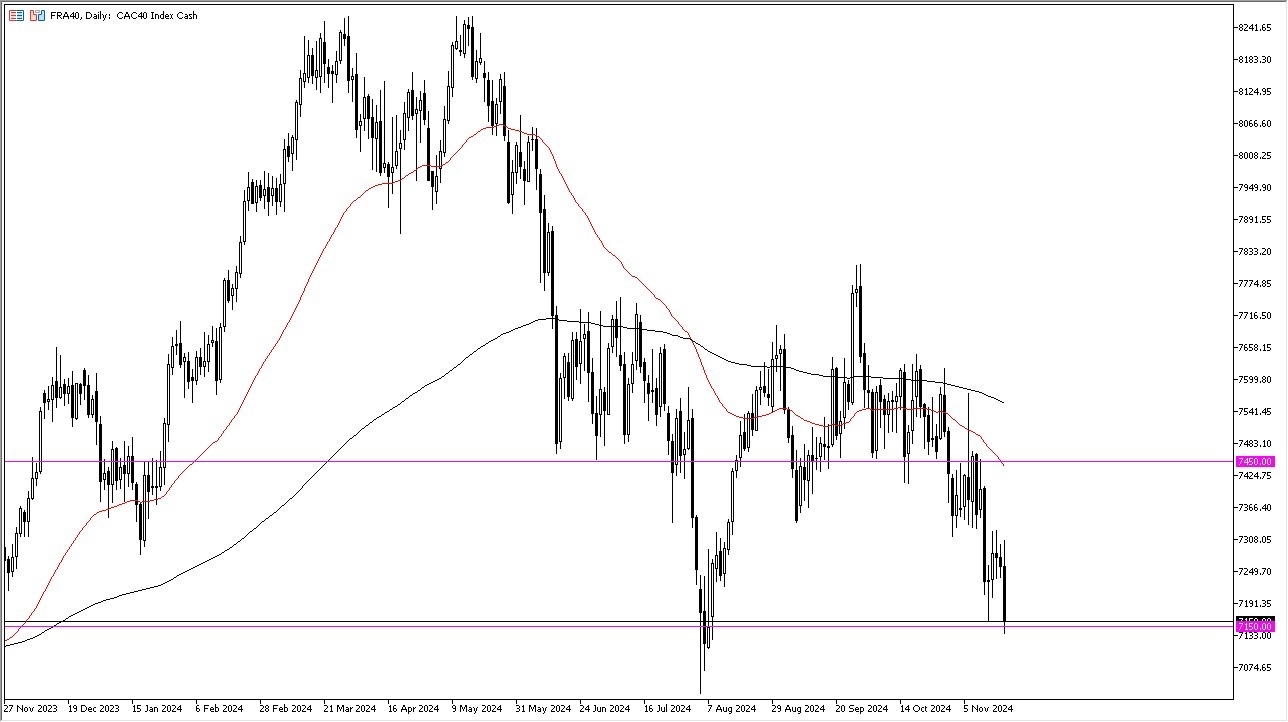

- During the trading session on Tuesday, we saw the Parisian CAC 40 fall rather drastically to reach the €7150 level.

- This is an area that has been important multiple times, and therefore I think we need to pay close attention to it now.

- The size of the candlestick of course is very negative, and I think we have to understand that the downward pressure continues to be a major factor here, based on the size of the move for the day.

If we were to break down below the €7150 level, then I think it opens up the possibility of a move to the €7000 level underneath. All things being equal, this is a market that is going to continue to be caught up in what is going on in the European Union, which quite frankly looks like a huge mess overall.

Top Forex Brokers

For example, one only has to look next-door in Germany to see economic chaos and geopolitical issues. Furthermore, it looks like the war in Ukraine could start to become an even bigger issue if NATO has its way, now that long-range missiles are being used. This will have a direct effect on pretty much anything European, and as the CAC 40 has been falling for some time, this is a market that will continue to struggle.

Technical Analysis

The technical analysis for this market is absolutely horrible, as the 50 Day EMA is sitting €300 above where we are right now and is dropping rather sharply. It’s also worth noting that the 50 Day EMA is sitting at the €7450 level, which is an area that has been important multiple times.

Furthermore, it’s also worth noting that the euro itself has been decimated, and it looks like almost all money is flowing into the United States at the moment. This puts some of the smaller indices such as the CAC 40 under serious pressure, as most traders can simply click a button and send money to New York instead of Paris. Rallies at this point in time will more likely than not end up being faded and shorted.

Ready to trade our daily stock market forecast? Here are the best CFD stocks brokers to choose from.