- In my daily analysis of European indices, the DAX 40 stands out head and shoulders above many others.

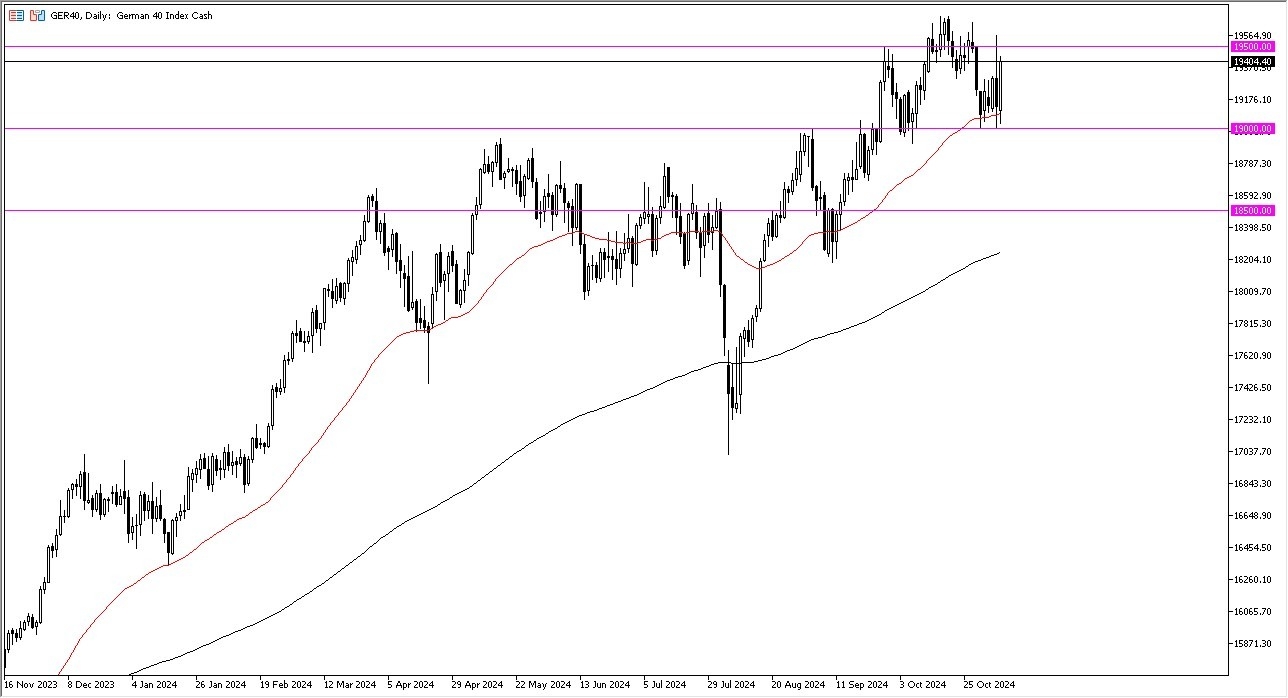

- The €19,000 level has held as support as we initially pulled back, and then the market took off quite drastically to gain about €400 from there.

- All things being equal, this is a market that has been very noisy for a while, and I think this shows us that we are trying to sort out where we are going to go in the longer term.

The fact that we continue to go sideways more than anything else does tell me that the market is probably comfortable at these high levels.

Top Forex Brokers

Technical Analysis

The technical analysis for this market is very bullish, but it also suggests that we may have to take a little bit of a break after running straight up in the air for several months. The €19,000 level continues to be a major support level, and the fact that the 50 Day EMA sits just above there does give us an opportunity to go to the upside as it looks like there will be plenty of buyers in that general vicinity. On the other hand, if we break above the €19,500 level, then we could make a serious attempt to break out to the upside and continue to go much higher, perhaps clearing the €19,750 level, which opens up the possibility of a move to the €20,000 level, which is obviously a large, round, psychologically significant figure.

The first thing I think of when we start talking about the German DAX 40 is that it is the largest index in the European Union. In other words, as the DAX goes, so goes the rest of the continent. The fact that the DAX has rallied the way it has during the trading session on Thursday lends itself to suggesting that other indices will continue to go higher. This is interesting and could be a great signal for many other markets that you could be training. All things being equal, this is a market that on every short-term pullback I’m looking for value to take advantage of.

Ready to trade our daily stock market forex analysis? Here are the best CFD brokers to choose from.