- The Euro has been all over the place against the Swiss franc during the trading session on Wednesday, as we continue to look at a market that just simply has no idea what to do with itself.

- This is interesting, and it's probably something that you should be paying attention to due to the fact that the Euro is considered to be a risk on currency while the Swiss franc is considered to be a risk off currency.

- In other words, this is a good measure of risk appetite around the world and especially with European union traders.

If market participants do feel a little bit more up about the idea of producing Alpha in the markets, they typically will buy the Euro and short the Swiss franc and then of course, the exact opposite.

Top Forex Brokers

On a Move Higher in this Pair

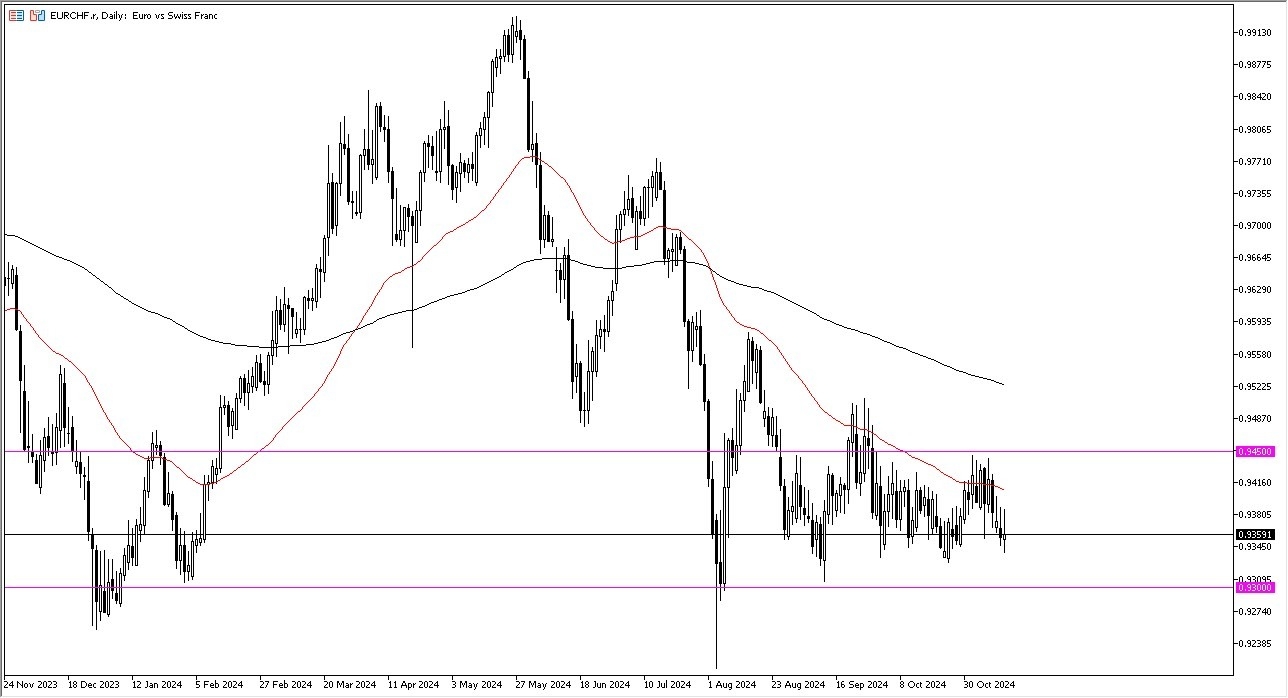

If we can break to the upside and clear the 0.9450 level, then I think you've got an opportunity where the Euro really could start to take off. We have been trading between the 0.93 level at the bottom and the 0.9450 level at the top in what has been rather quiet and uninteresting trading. However, markets only go sideways for a certain amount of time.

I do think that once this EUR/CHF market breaks out, it could be a very big move. A breakdown below the 0.93 level could drop this pair down to the 0.90 level. While a move above the 0.9450 level opens up the possibility of a challenge to the 200 day EMA. If we can break above that, then we really could start to take off and go looking to the 0.9750 level. Obviously, this is a pair that gets a lot of external pressure put upon it, so you have to watch the overall markets in general to get an idea of which one of these currencies are more likely than not to benefit.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.