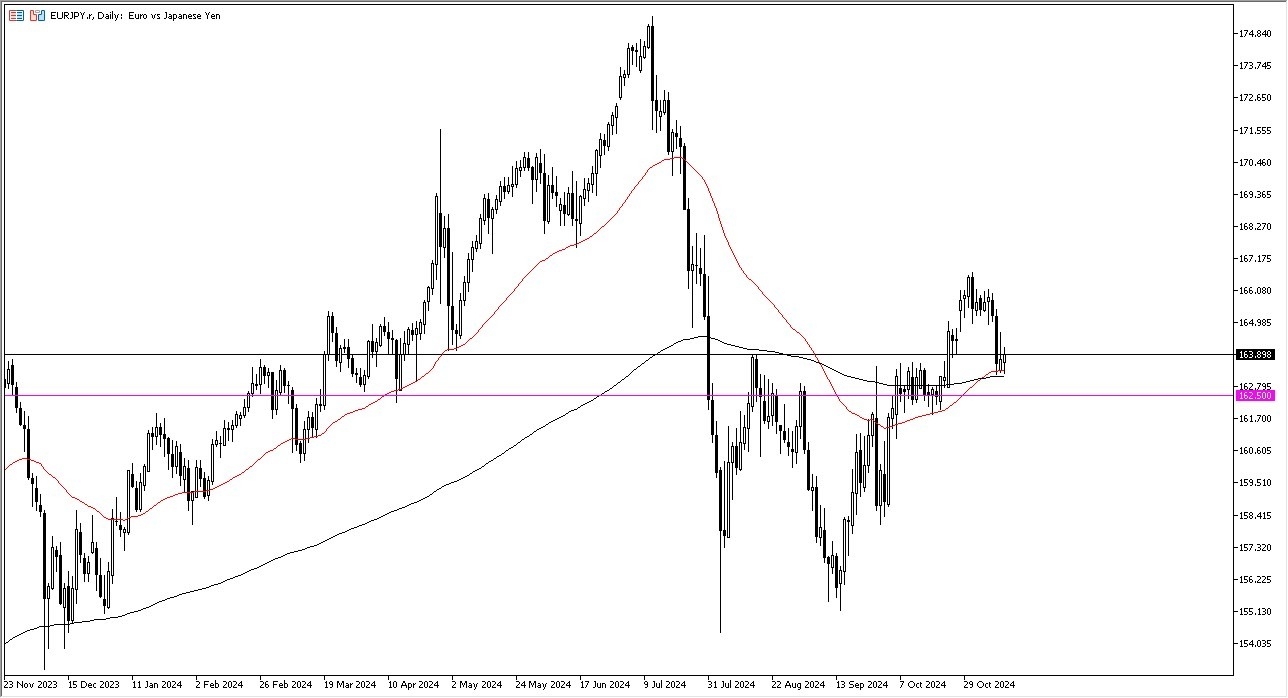

- The Euro has gone back and forth during the early hours on Tuesday against the Japanese Yen as we are hanging around the 50 day EMA.

- It's worth noting that this pair does have a positive swap.

- So of course, a lot of people are looking at this through the prism of the carry trade.

- If we do break higher from here, it looks like we are at least going to try to break above there.

The 165 yen level is the gateway to the market going higher. We had recently broken out of a significant consolidation range. And we, in the last 24 hours, have tested the 50-day EMA as well as the 200-day EMA indicators. So, I think it all lines up for a bit of a bottoming and bouncing pattern.

Top Forex Brokers

If we were to break above the inverted hammer, during the trading session on Monday, that would also reinforce the idea of a break above the 165 yen level breaking above the 167 yen level then opens up the possibility of a much bigger move. And I do think that happens given enough time. The interest rate differential does favor holding this EUR/JPY pair, although I'm the first to admit that the euro is not as enticing as something like the US dollar or the British pound against the Japanese yen.

JPY-related Pairs Move Together Normally

Nonetheless, the yen related pairs all do tend to move in the same direction. And that's something that needs to be paid close attention to. With this, I'm looking for some type of momentum in this market to send the euro higher. At that point, I'm more than willing to start buying. If we were to break down below the 161.50 yen level, then that could be fairly negative, but I would anticipate you would see the yen strengthening against almost everything at that point.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.