- The euro initially fell a bit against the US dollar during the trading session on Thursday as Thanksgiving would have caused a little bit of liquidity problems in the market.

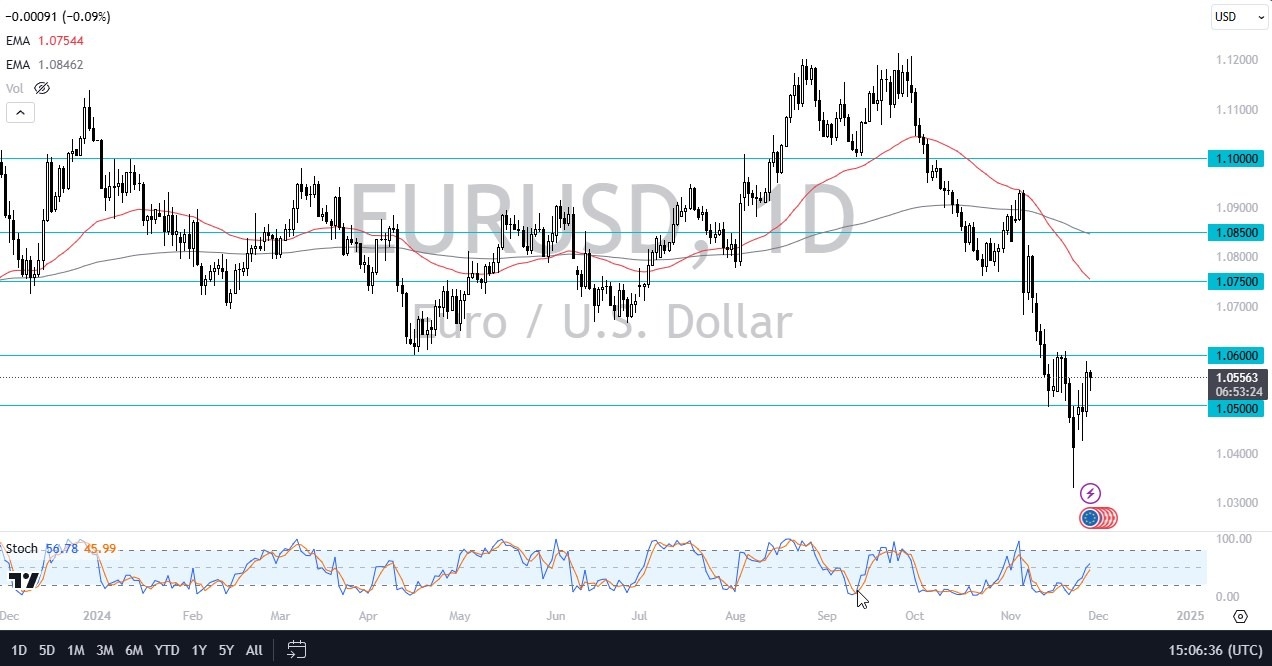

- That being said though, we have been more or less going sideways for a while and the 1.06 level above is a major resistance barrier.

- If we can break above the 1.06 level and go looking to the 1.0750 level. I think that's what is trying to happen.

But ultimately, this is a pair that I still think would favor the US dollar longer term. The fact is that the United States is about to enter a renaissance in the business world, at least as far as the way the government approaches it. And one would think that there will be a lot of investment in America.

Top Forex Brokers

Geopolitics Still Matter

At the same time, we have the land war in Ukraine, and it is getting hotter. So, I think the upside in the euro is a little somewhat limited in that sense as well. The EUR/USD market looks very much like one that is just bouncing from an oversold condition, which makes quite a bit of sense. The US dollar has swallowed everything over the last several months.

With this being said, I expect short-term traders to be buyers of euros and longer-term traders to look for some type of opportunity to pick up cheap dollars. It is a bit of a two-speed market. It just depends on what timeframe you're looking at. But like I said, based on the action that we've seen over the last couple of days, we are doing everything we can to break above 1.06 and I am seeing similar action in other currency pairs, such as the British Pound. After all, it’s quite common for these pairs to move based on the US dollar itself, as in general, if you can get the trajectory of the US dollar correct, you can generally do okay when it comes to most forex pairs.

Ready to trade our daily EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.