- During my daily analysis of the global indices, the FTSE 100 is something that I was paying close attention to due to the fact that the Bank of England had an interest rate decision.

- That would have a lot of people paying close attention to the United Kingdom in general.

- After all, the market will have to deal with whatever interest rate decision happens, which of course in this case was a cut of 25 basis points, but what I have seen here has been a lot of questions.

This makes a lot of sense, considering that the Bank of England cut interest rates, but also stated that they were worried about inflation. This is traders thinking that perhaps the market is likely to continue to see higher interest rates in the United Kingdom over the longer term, and if that’s going to be the case, it does cause a little bit of downward pressure on the stock market. On the other hand, we could grow our way out of some of the inflation issues, and perhaps some people are starting to think that.

Top Forex Brokers

Technical Analysis

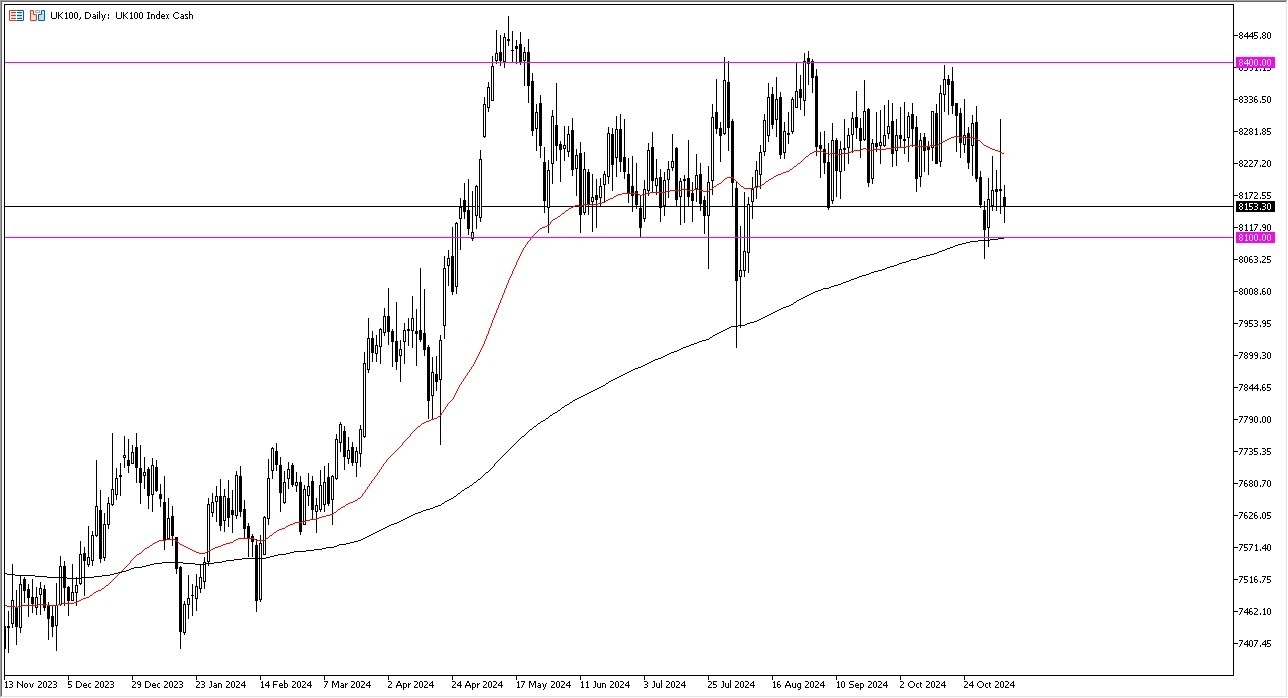

The technical analysis for this FTSE market is still bullish, but we are definitely threatening the bottom underneath. The 200 Day EMA currently hangs around the 8100 level, which of course is an area that people have seen act as support multiple times, as well as previous resistance. At this point in time, I think it’s probably only a matter of time before the buyers come in and start buying in this market, pushing it higher. The 50 Day EMA sits near the 8250 level, and if we were to break above there then it’s likely that we could go looking to the 8400 level. That’s an area that of course is a major resistance barrier, so if we were to break above there, then I think it’s likely that we could go looking to the 8500 level.

Short-term pullbacks will continue to be buying opportunities, unless of course we break down below the 8000 level. If we were to break down below the 8000 level, then it’s likely that the market will correct even more aggressively. With this being the case, I think you have a situation where traders are looking for value and London.

Ready to trade the daily stock market forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.