- Gold initially rallied during the trading session on Friday as the jobs numbers came out at adding just 12,000 for the previous month in the United States.

- That being said, the market has given back quite a bit of those gains.

- I think at this point in time, you've got to look at this through the prism of a market that may just be a little overdone.

A Pullback Coming?

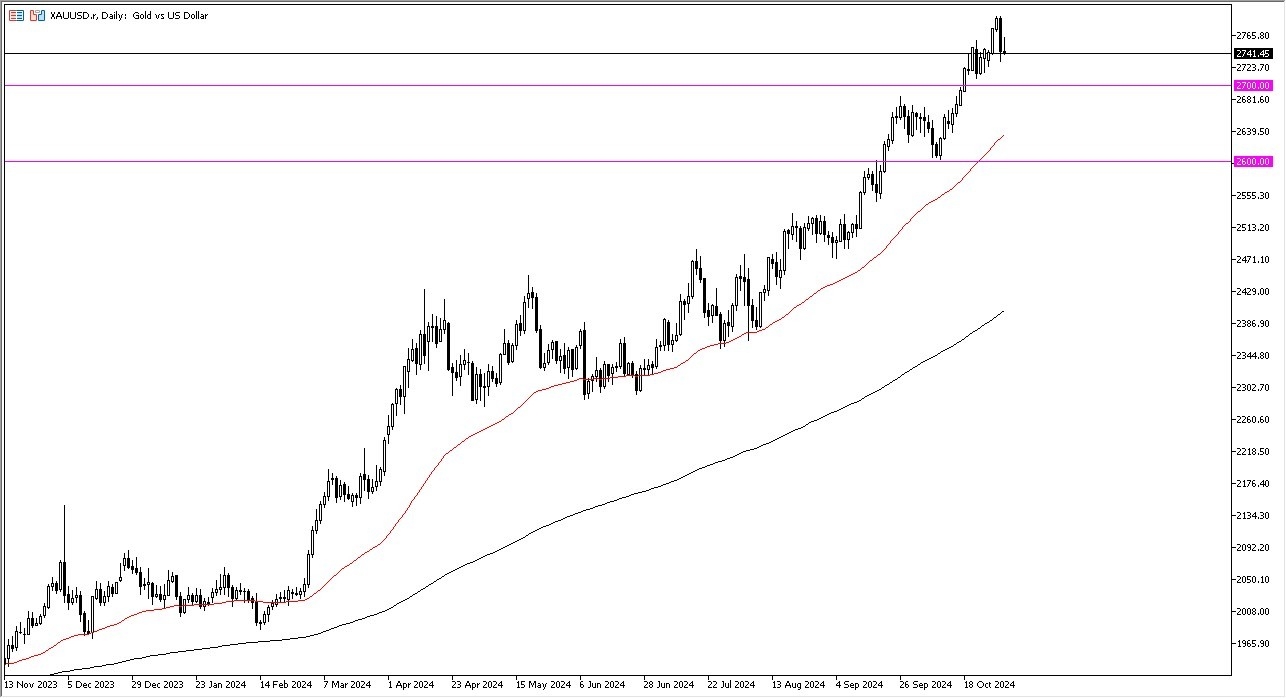

The fact that we gave up the gains and rolled over suggests that perhaps we could drop towards the $2,700 level. The $2,700 level should see a significant amount of support, but breaking down below there then opens up the possibility of a drop all the way down to the 50-day EMA. As long as we stay above the $2,600 level, I am a buyer of dips, and I will be looking for value in the gold market.

Top Forex Brokers

All things being equal, this is a situation where you just can't short gold despite the fact that it looks very weak in the short term. I think at this point in time, you saw plenty of geopolitical issues out there that could drive gold higher as the Middle East is still basically on fire. And then of course, we have the hot war in Ukraine and there's almost unlimited tension going on.

Beyond that, we have central banks around the world cutting rates. And then we have, of course, the overall technical analysis, which is very strong. And I do believe that the simple momentum play here is starting to come into the picture. Tuesday has the US elections. And that, of course, could cause a little bit of volatility as well. Either way, I'm looking to pick up little bits and pieces every time we pull back in order to take advantage of cheap gold ounces, and of course this is a situation where we are looking for value.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.