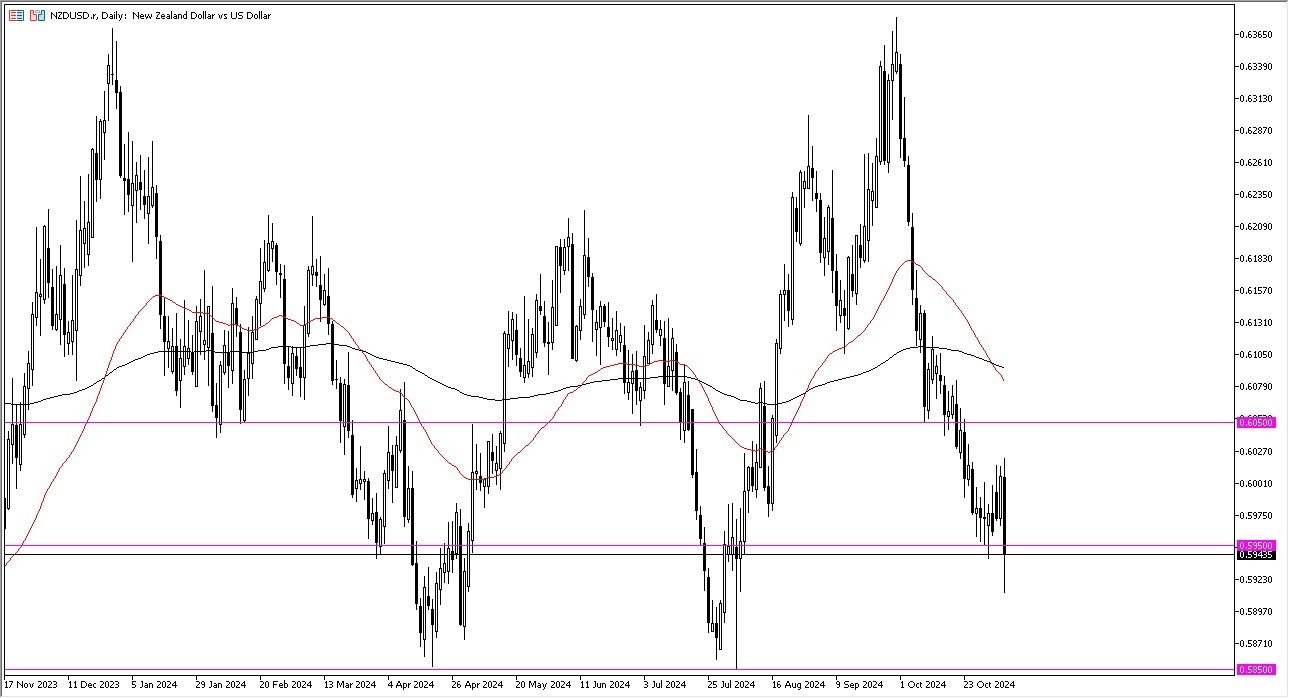

- During my daily analysis of the NZD/USD pair, the first thing I see is that we have broken down below the 0.5950 level, an area that previously had been important.

- This is an area that previously had been both support and resistance, so it does make a certain amount of sense that we are seeing a little bit of action here.

- If we were to break down below the bottom of the candlestick, then it could open up the possibility of a move down to the 0.5850 level underneath. This is an area that would be essentially the “trapdoor” in the overall trend of the market.

The size of the candlestick suggest that there is a certain amount of downward pressure, and of course is probably worth noting that the 50 Day EMA has broken down below the 200 Day EMA. With this being the case, there is the so-called “death cross” that just happen, which of course is a very negative turn of events and of course something that longer-term traders will pay close attention to.

Top Forex Brokers

New Zealand Dollar and Risk Appetite

The New Zealand dollar is of course very sensitive to risk appetite as it is considered to be a so-called “commodity currency.” New Zealand exports a lot of soft and agricultural commodities to various countries around Asia, and of course therefore it makes it very sensitive to the economic winds in places like China, Indonesia, Japan, etc.

If we do rally from here, then it’s possible that we could go looking to the 0.60 level, a large, round, psychologically significant figure, and therefore I think a lot of people will be paying close attention to it. With this being the case, I think you have got a situation where traders will look at this as a simple reflection on whether or not people were willing to put money to work in riskier assets.

Furthermore, it also can give you little bit of a “heads up” as to what people think will happen with the US economy itself, as it looks like the election of Donald Trump and the Republicans could make it a much more business friendly situation in America.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.