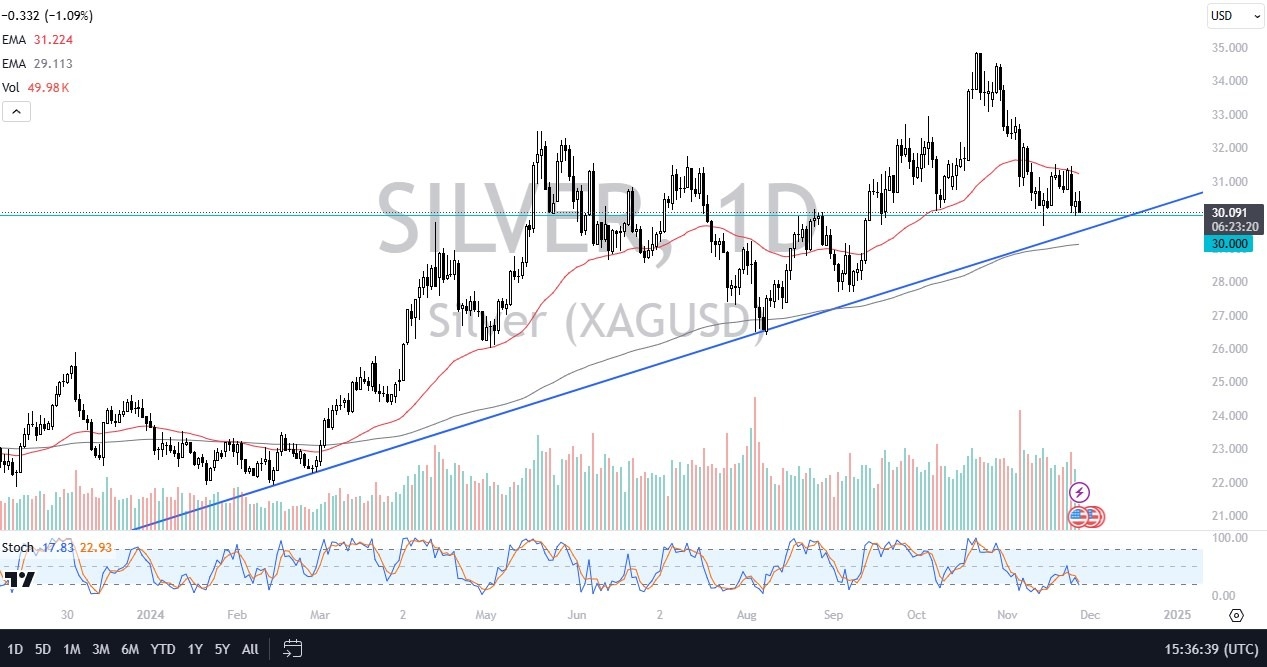

- During the analysis of the silver market, the first thing that comes to mind is that we gave up gains rather quickly, and now we continue to look at the $30 level underneath as a major support level.

- The $30 level of course is a major round figure that a lot of people will be paying attention to, not only due to the fact that it has a lot of psychology attached to it, but it is also an area that has seen support and resistance come into the picture multiple times.

- Because of this, and the fact that we have a trendline just below there, I think we are at a very important point on the chart as silver will either “put up or shut up” at this point.

It’s worth noting that the silver market will be heavily influenced by Thanksgiving, due to the fact that the futures market will be closed for about half of the day, and therefore liquidity may be a bit of an issue in the next 24 hours. However, this is a market that continues to see a lot of questions asked of it, and if you squint, there could be very ugly signs from a technical analysis standpoint, or at least, I would say there are a lot of mixed signals.

Top Forex Brokers

Technical Analysis

The technical analysis is somewhat neutral over the last couple of weeks, and we did have a significant pullback. However, we have a uptrend line that has held quite nicely, and then of course we have that $30 level which is rather crucial as well. We are between the 50 Day EMA and the 200 Day EMA indicators, which is typically an area where you see a lot of support also. However, I would also point out that we are possibly forming some kind of head and shoulders pattern, which is obviously bearish.

Regardless, I think silver continues to underperform gold and will continue to suffer at the hands of the US dollar for continues to strengthen. I think we need to see silver break above the 50 Day EMA, near the $31.40 level, in order to go higher and eventually go reaching to the $35 level. If we break down below the $20 level, silver could fall apart completely.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.