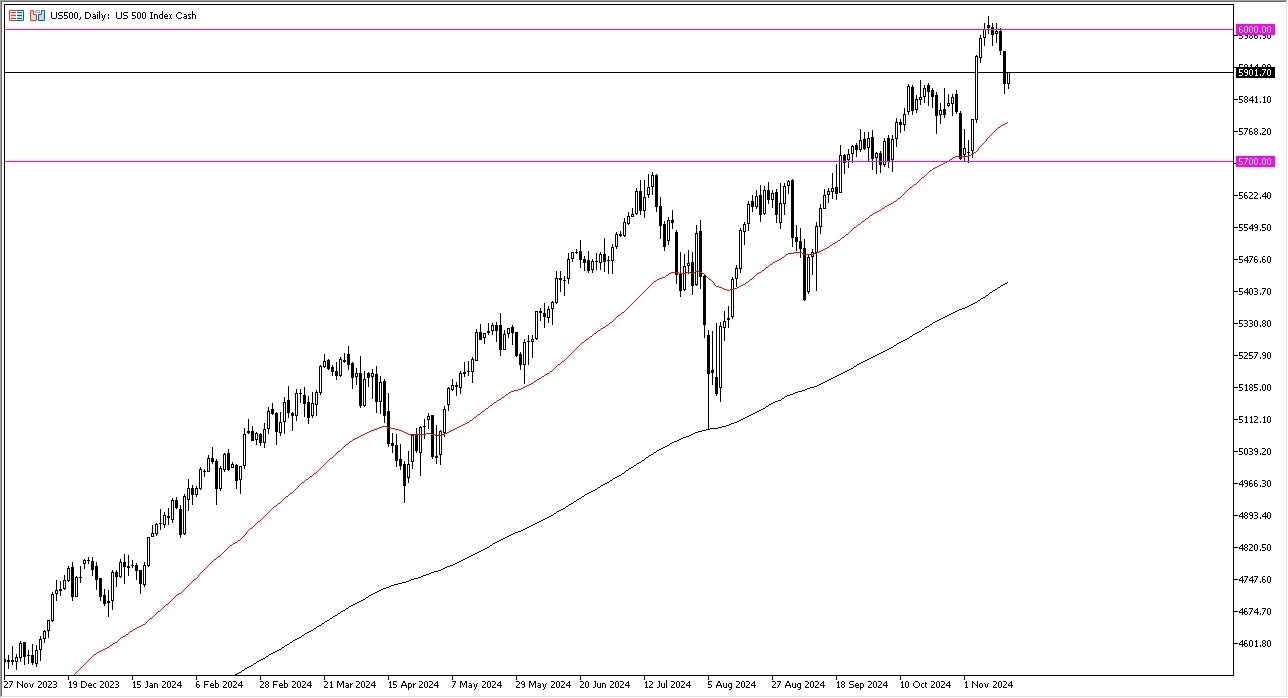

- During my daily analysis of US indices, the S&P 500 has shown itself to be bullish, as buying the middle of the New York session, the market has reached the 5900 level.

- While the 5900 level isn’t necessarily a massive level from a market memory standpoint, it is a large, round, psychologically significant figure, and if the market can overtake this area.

- It’s very likely that we will see a bit of follow through at this point, perhaps allowing the S&P 500 to go back to the more important level of 6000, the same area had pulled back from.

Top Forex Brokers

Election and So Much More

While the election of course was something that a lot of people paid attention to, and it of course had a lot of positive momentum come flying into the S&P 500, the reality is that it’s not just the US election that has moved the S&P 500 in this direction. Yes, you can make an argument that the Trump administration will probably be more pro-business, but furthermore it’s likely that with the Republicans taking the Senate and the House of Representatives, that tax policy will probably be more lenient.

Beyond that, this sets up an interesting situation. There’s a very real argument to be made that the United States will lead the world in growth, at least as far as major developed economies are concerned. The Europeans will lag, so I think that at this point in time you are starting to see a lot of European money flow into the New York indices. As long as that’s the case, it makes quite a bit of sense that the S&P 500 will continue to perform fairly well. It is also worth noting that we have tested the 50% Fibonacci retracement level from the shot higher that was so prominent last week, and therefore I think a lot of people are looking to get involved in a market move that they may have missed, out of fear of what the political ramifications of the US elections might cause.

Ready to trade our daily stock market forecast? Here are the best CFD stocks brokers to choose from.