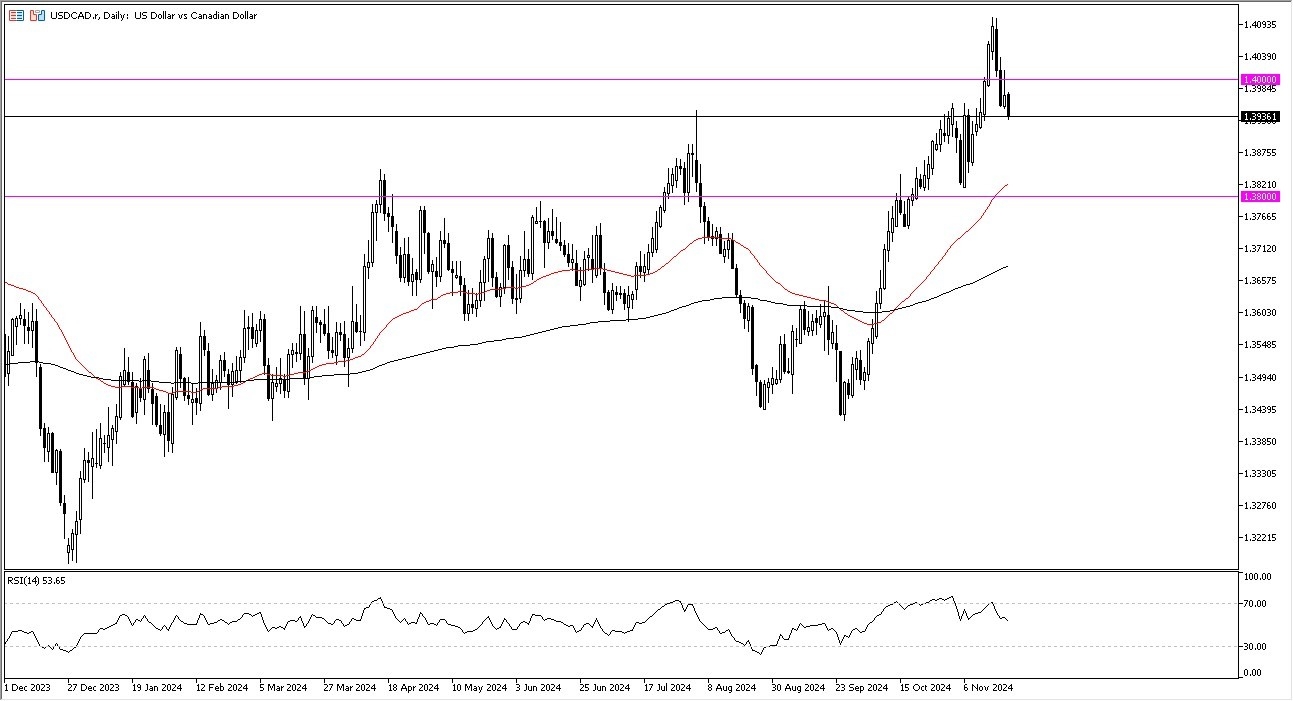

- During my daily analysis of the USD/CAD pair, the market looks as if it is trying to find its bottom, after a short-term pullback.

- Initially dropping below the 1.3950 level, only to turn around and form a bit of a hammer.

- All things being equal, the market were to break above the top of the candlestick for the Thursday session, it’s very likely that the US dollar could go looking to the 1.40 level above.

The market has been in a long term uptrend, and I think that will continue to be how this market behaves, was of course we get some type of major shift in the fundamental factors.

Top Forex Brokers

Friday Could Be Important

Keep in mind that the Friday market could be an important one, due to the fact that we get the PMI numbers coming from both the Services and Manufacturing sectors in the United States, as well as other parts of the world. Beyond that, we also have to keep in mind that the bank of Canada has recently cut interest rates multiple times, as has the Federal Reserve, but the difference is that the interest rates in the United States continue to climb, as bond vigilantes continue to get involved. If that continues to be the case, then the higher interest rates in the United States will continue to attract inflows.

The United States is the only place where people are willing to throw massive amounts of money it seems, as we have seen both the US dollar, as well as equities markets, rally over the last several weeks. The election seems to have brought a bit of clarity going forward, and therefore I think it makes quite a bit of sense that we would see the United States prevail over Canada, which of course is more or less a commodity-based economy that supplies the United States with a lot of raw materials. In other words, it needs a strong United States to function, so these 2 currencies are so massively interconnected that we often see a lot of noise. As things stand right now, USD/CAD is a market that looks very bullish.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.