- The US dollar has gapped to the downside during the early hours on Friday, only to turn around and rally, before giving up those gains again.

- With that being the case, the market is likely to continue to see a lot of volatility and choppiness but having said that we also have to keep in mind that the market is going to be cognizant of the fact that the US dollar is overbought at the moment, so a bit of a pullback does make quite a bit of sense.

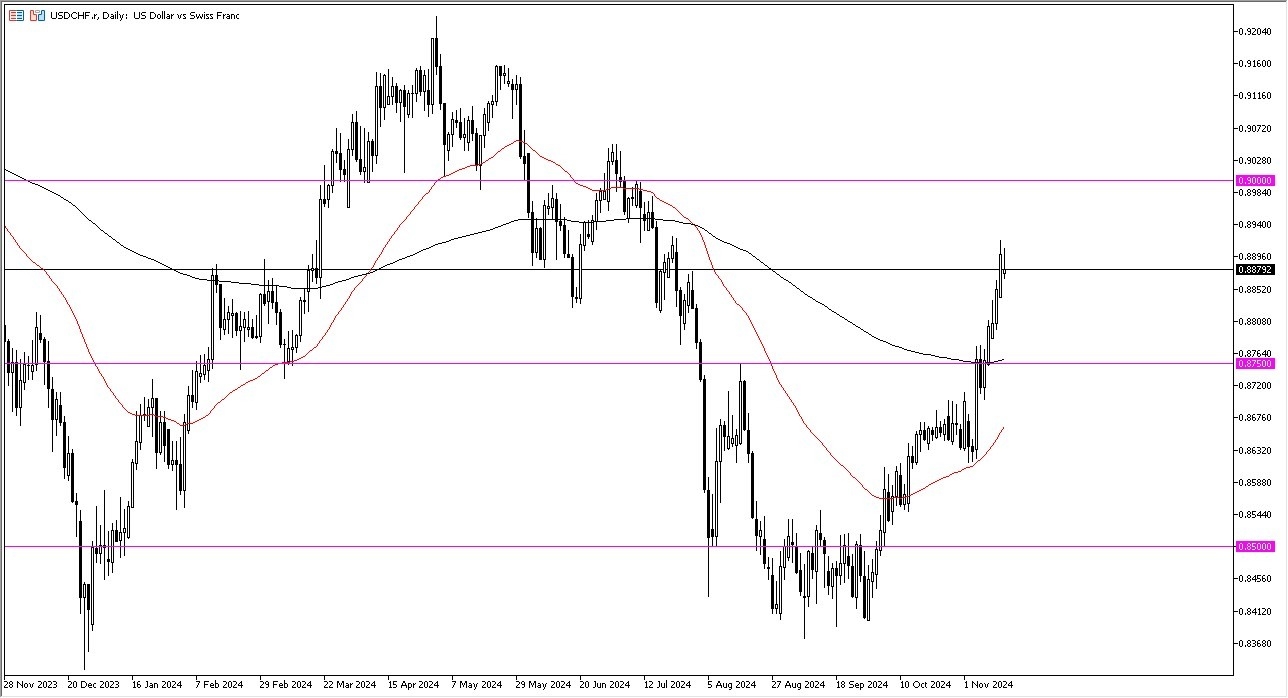

At this point in time, the 200 Day EMA sits right around the 0.8750 level, and is curling higher. This is a reason that I have been paying close attention to, as it is an area that has previously been resistant, so I think a certain amount of “market memory” would come into the picture. All things being equal, this is a market that has been bullish for some time, but you do need to digest some of the gains before you can find new buyers to jump in and take advantage of what I believe is a new trend now.

Top Forex Brokers

Interest Rates

The interest rates in the United States are much stronger than as Switzerland, especially when you look at the bond market which has been selling off quite viciously. This is despite the fact that the Federal Reserve has cut rates, but it looks like bond traders are simply choosing to ignore the Federal Reserve overall.

Nonetheless, I think given enough time we will see the US dollar pick up more traders to send this market to the upside. If we were to break down below the 0.8750 level, then we would probably see an even deeper correction, perhaps even a repudiation of the attempt to break out. That being said, you do get paid to hang on to this pair and I think that is something that you cannot ignore at this point in time.

Ready to trade our daily Forex analysis? We’ve made a list of the top brokers in Switzerland for you.