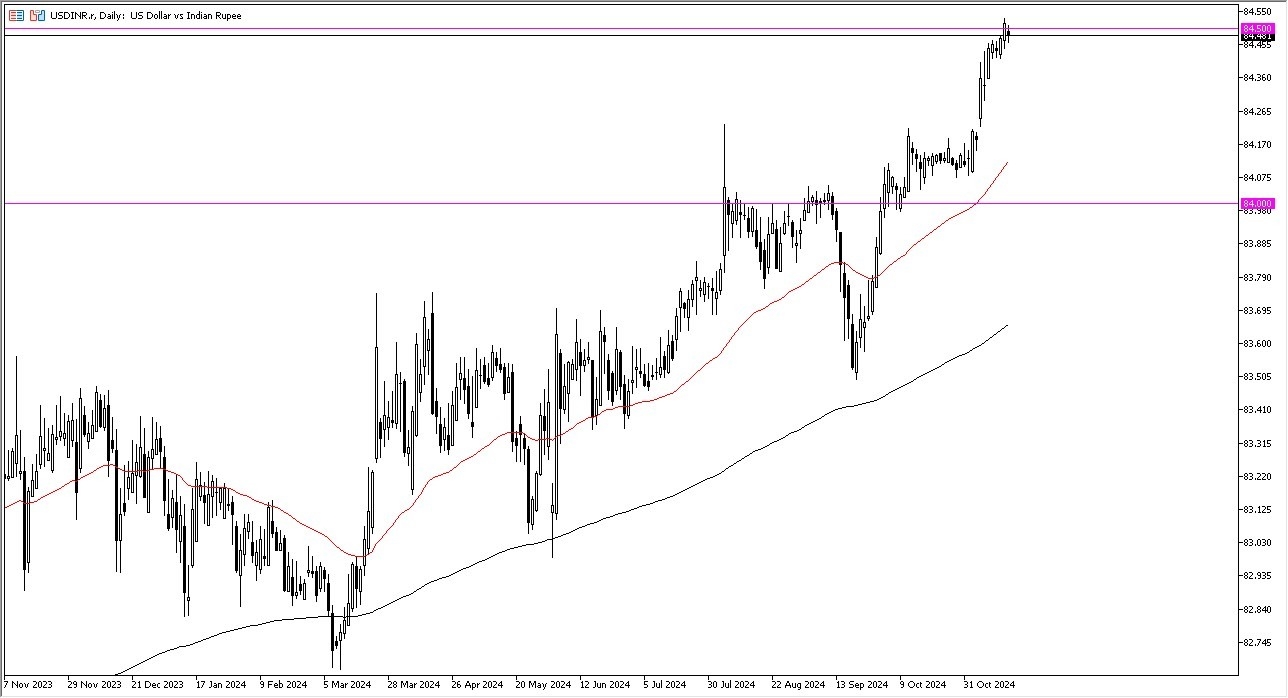

- During my daily analysis of exotic currency pairs, the USD/INR pair has caught my attention, as we continue to threaten a major resistance barrier.

- The ₹84.50 level of course is an area that would attract a lot of attention anyway, and the fact that we are just simply hanging around this area over the last couple of days suggest that we are quite ready to take off to the upside.

- But it is also worth noting that we continue to see pressure on this level, nonetheless.

Top Forex Brokers

Risk Appetite

The risk appetite the USD/INR pair of this currency pair is simply put as the US dollar against riskier emerging market economies. In other words, the market has seen a lot of questions asked of the US dollar, as traders are worried about the overall global economy, which makes the US dollar much more interesting for traders to hold. Furthermore, lot of people will jump into the bond markets, at least in the United States in order to protect their portfolios.

On the other hand, the Indian rupee of course is a longer-term “risk on” type of trade. After all, India is a major powerhouse when it comes to emerging markets, and it gives you an idea as to where the growth may or may not be coming from. India is one of the biggest economies in Asia, so with this being the case I think you’ve got a situation where whether or not the Asian economy expands will have a major influence on Indian exports.

Furthermore, you should also keep in mind that risk appetite can be somewhat dampened due to the fact that the Bank of India also keeps its thumb on the scales when it comes to the exchange rate of the Indian rupee. Because of this, think you got a situation where traders will have to look at this through whether or not things are improving from a longer-term outlook, or if things are going to get much more dire.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.