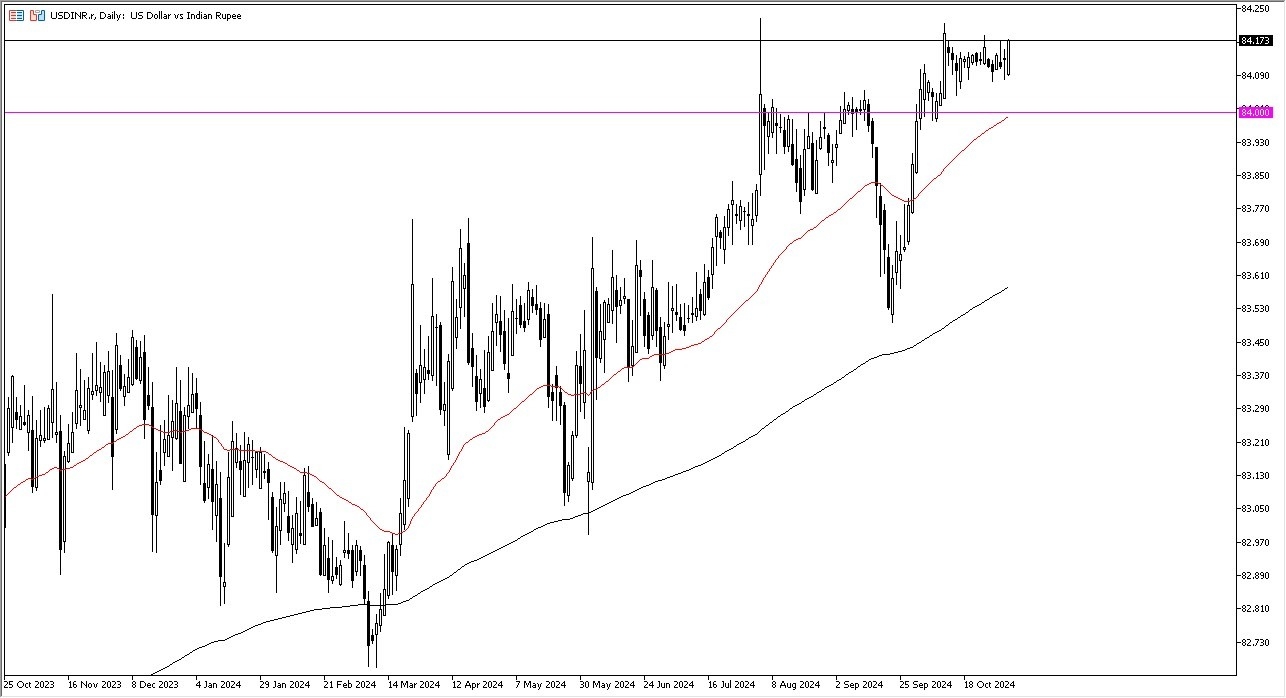

- During my daily analysis of exotic currency pairs, the first thing I notice about the USD/INR pair is that we are right back to the recent highs yet again.

- While the candlestick of course is very bullish, the reality is that we have had a lot of trouble getting above the 84.22 level, so I think we still have quite a bit of work ahead of us, and of course this week could be the catalyst for a breakout.especially as we are going to see so many important fundamental announcements.

The first thing of course will be the US elections. This will almost certainly cause some type of volatility in the US dollar, and one would have to think that in the exotic currency pairs, things could get out of hand rather rapidly.

Top Forex Brokers

Furthermore, we also have the Federal Reserve and its interest rate decision on Thursday, which is expected to be a 25 basis point rate cut. If the statement shocks Wall Street, that’s where the trouble could start on Thursday. Keep in mind that most traders believe that the Federal Reserve is in fact going to lay the groundwork for sitting still for a while, perhaps bringing in a “higher baseline” when it comes to interest rates.

Technical Analysis

The technical analysis for this pair is obviously very bullish, and I’m very interested in the 84 level, as it is not only a large, round, psychologically significant figure and an area where we have seen some action at previously, but it also features the 50 Day EMA now, which in and of itself could attract a lot of attention.

Any move below that level could get a little bit more selling pressure going, but I suspect at this point it would probably have a lot to do with the US dollar falling worldwide, not just against the rupee.

For what it is worth, we certainly are “leaning to the upside”, so my first thought is that most pullbacks should end up being buying opportunities in this market, which is generally the case overall. After all, this is not the type of economy on a global scale that you are looking to take massive amounts of risk with, and it is worth noting the interest rates in America continue to climb despite the fact that the Federal Reserve has cut, via the bond markets.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.