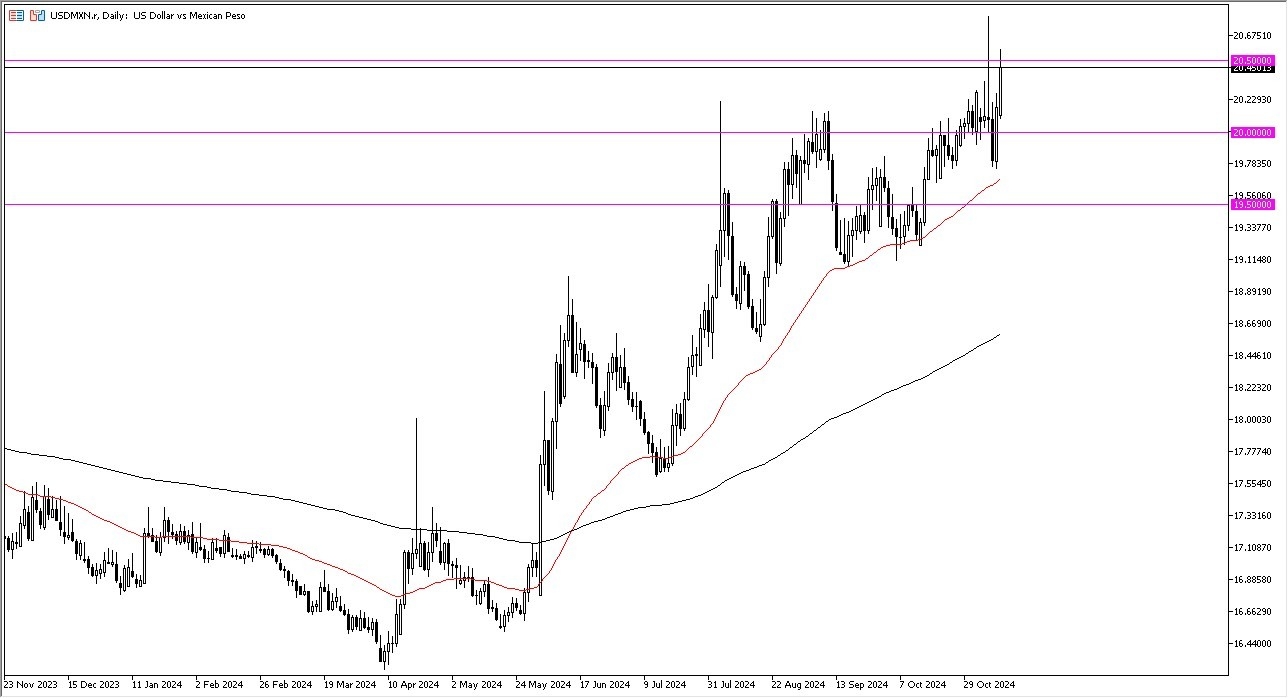

- The US dollar rallied rather significantly during trading on Monday again as we have pierced the 20.50 level.

- The market breaking to the upside the way it has continues to be the main story here as interest rates in America continue to strengthen but we have a whole plethora of reasons to believe that that the US dollar may continue to swallow the Mexican peso whole.

- The first thing is the fact that the immigration policy in the United States just changed completely. It's going to do a 180 and it's likely that what we are going to see is a lot of migrants going home.

- If that's going to be the case, then you've got a situation where there will be less remittances back into Mexico from the United States.

It sounds odd and almost fantastical, but it really does have a major influence on what happens in this USD/MXN currency pair. Furthermore, if we start to see more of an America first approach, it does favor the US dollar.

Top Forex Brokers

Furthermore

Beyond that, if we have a little bit of a risk on move, then that favors the Mexican peso. But right now it looks like the markets are at least somewhat uncertain. And furthermore, we also have to keep in mind that if yields continue to climb in the United States, that makes the US dollar a little bit more attractive. We may be seeing a little bit of a knock-on effect from other currency pairs.

Remember the US dollar and the Mexican peso trade in limited hours through most brokers. So a lot of this is a reaction to what happened overnight, for example. Short-term pullback should continue to be buying opportunities with the 20 level being an obvious important area. But we also have the 50 day EMA right around the 19.6 level, followed by the 19.5 level. With this being said, I think this is a market that although a little stretched, still continues to look very positive overall.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.