- The US dollar against the Mexican peso has captured my attention, mainly due to the fact that out of all of the exotic currencies that I follow for Daily Forex, this is the one that is getting the closest to some type of major shift in momentum.

Technical Analysis

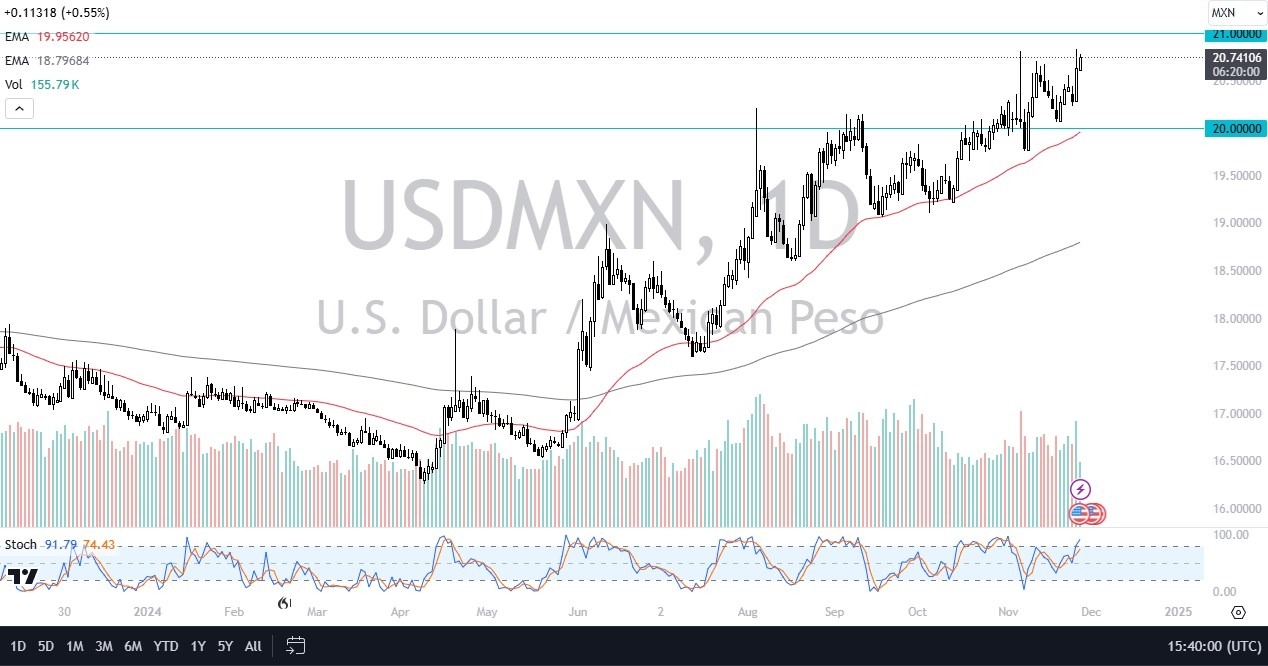

When I look at the technical analysis, this is a very bullish market, but we have a real significant amount of resistance at the 21 MXN level that could cause quite a few headaches. However, if we can break above that level, then we are threatening a real “FOMO move” to the upside. In fact, if we can get above the 21 MXN level, it’s possible that we could go as high as 24 MXN! Obviously, that would take a certain amount of time to make it happen, but there are a ton of reasons to think this could play out.

Top Forex Brokers

The 50 Day EMA sits right around the 20 MXN level, and I think that is the short-term floor in the market. As long as we can stay above that level, it’s likely that the market will continue to see buyers jumping into the market, as the US dollar is the favorite currency around the world at the moment.

All of this being said, there are a lot of things to think about when it comes to this pair. The election of Donald Trump will be like a wrecking ball for the Mexican peso under certain circumstances, and he has already threatened Mexico with 25% tariffs if they do not close the border. The thing about this threat is that he’s deadly serious, it has a history of doing such things. The Mexicans are saying that they are willing to close the border and therefore they may avoid this. However, one thing is for sure at the moment, the US economy is the place where people want to be, and it’s also worth noting that deportations of up to 1 million illegals a year in America could put a major dent in those remittances that this USD/MXN pair is so widely known for. In other words, we could see this market continue higher over the longer term. However, if we were to turn around a break down below the 19.50 level, then I would have to reevaluate everything.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.