- During my daily analysis of exotic currency pairs, the USD/MXN and pair has captured my attention, due to the fact that we have seen a significant drop during the session.

- That being said, you should probably keep in mind that it was Thanksgiving in the United States, so volume will have been minuscule.

- That’s especially true with this pair, which is almost exclusively traded during North American hours, at least as far as any real size is concerned.

Technical Analysis

Top Forex Brokers

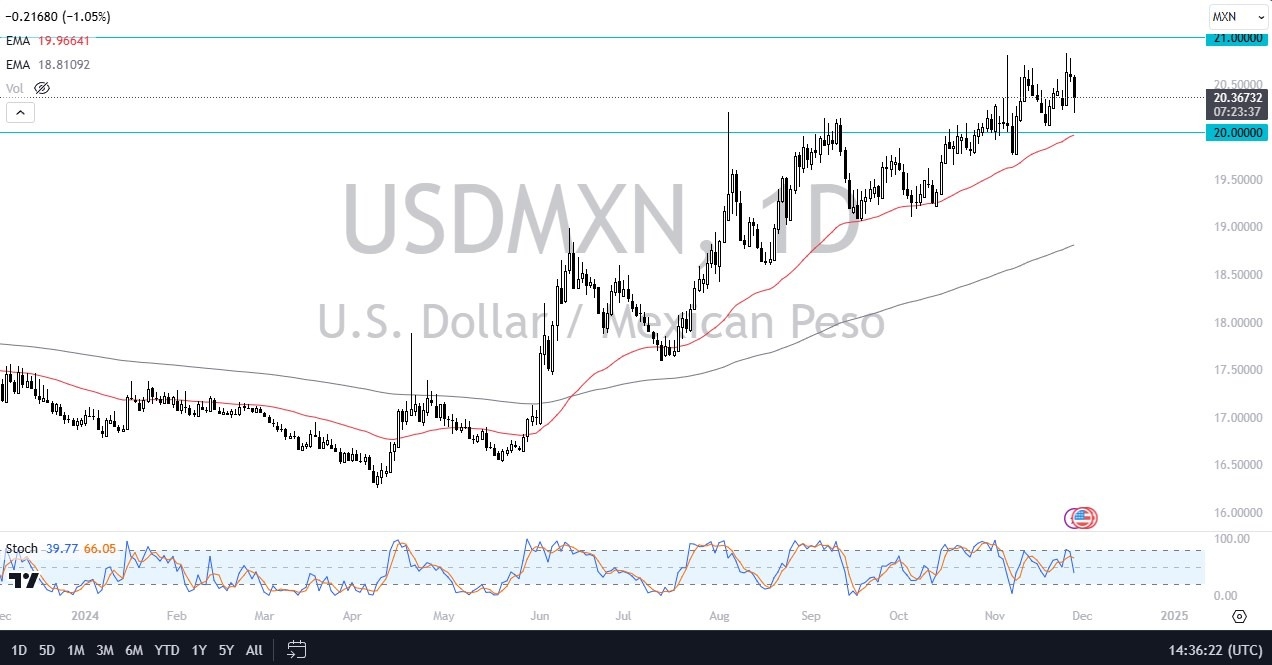

The technical analysis for this USD/MXN pair looks somewhat neutral with an upward slant. If we drop from here, the 20 MXN in level is an area that I think a lot of people will be watching, because it’s a large, round, psychologically significant figure, and an area that previously had been significant resistance. Adding more credence to the 20 MXN level is the fact that we have the 50 Day EMA hanging around the same area, and is rising at the moment, acting more or less as a trend line over the last several months. In other words, think there would be a lot of buyers looking at that as a potential buying opportunity.

That being said, we have already bounced a bit from the lows of the day, so I think you’ve got a situation where there will be plenty of value hunters willing to take advantage of the US dollar, perhaps reaching the 21 MXN level. The 21 MXN level is an area that has been important multiple times, and if we can break above there, then I think it’s likely that this pair really starts to take off in some type of FOMO trade, and it could open up a move all the way to the 24 MXN level.

I believe between now and January 20, we are likely to see a lot of sideways action based upon the latest rhetoric coming from Donald Trump. After all, he has threatened a 25% tariff on Mexican goods unless the border is sealed. The Mexican seem to be willing to play ball, so that might avoid that issue, but until then I think a lot of traders are somewhat up in the air at this point.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.