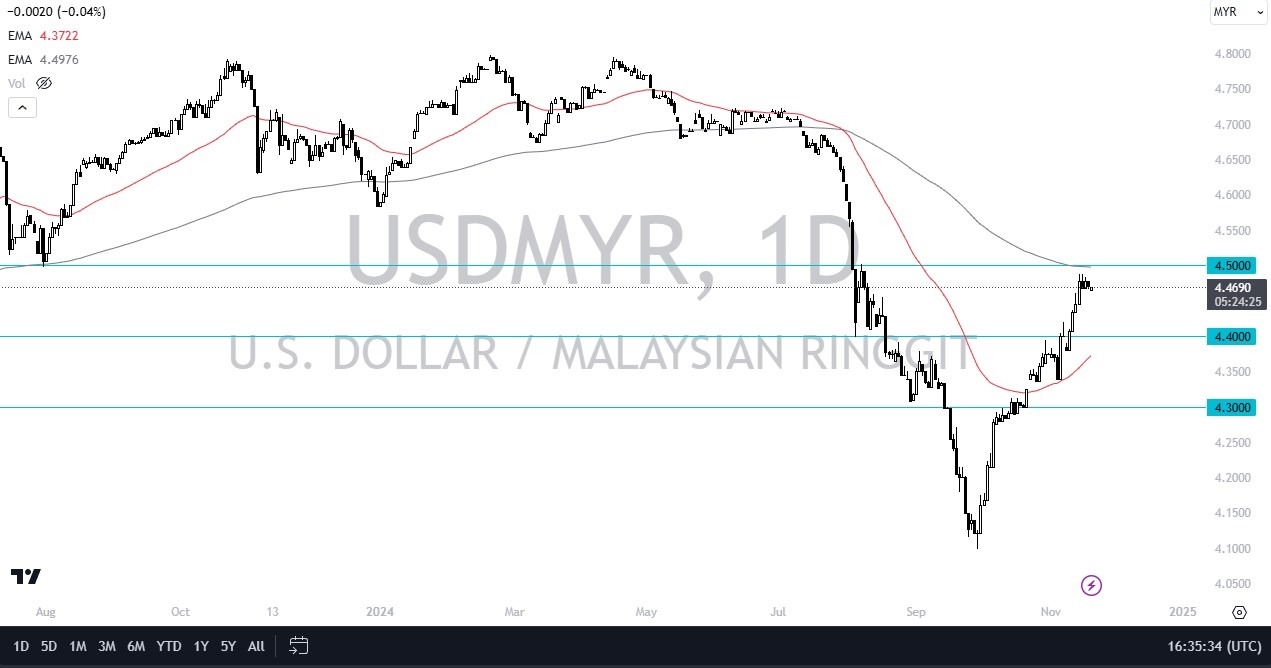

- During the trading session on Wednesday, the US dollar has continued its consolidation against the Malaysian ringgit, as we are sitting just below the crucial 4.5 MYR level, which also features the 200 Day EMA.

- If we can break above all of that, it would obviously be a very important signal that we are going to go much higher.

This would make a certain amount of sense, due to the fact that interest rates in America continue to climb, and quite frankly the United States is essentially the “only game in town” when it comes to traders.

Top Forex Brokers

While the Malaysian economy has been very strong as of late, the reality is that the entire world is throwing money at America right now, due to the election, and then of course the fact that interest rates continue to rise regardless. After all, the Federal Reserve has cut rates multiple times, but the bond market doesn’t seem to care at this point in time. With this being the case, I think you will continue to see the US dollar be attractive.

Resistance Above

That being said, the 4.5 MYR round, psychologically significant figure and the fact that we have the 200 Day EMA sitting right there, could be enough to keep the market somewhat down. I would not be surprised at all to see this market pull back just a bit, only to turn around and smash through it eventually.

Pay close attention to the US dollar against other emerging market currency such as the Norwegian krone, South African rand, Chilean peso, etc. in order to get an idea of where the market is going as far as the US dollar again several other smaller currencies, not just the Malaysian ringgit. If we do break out to the upside, then I think we have a real shot at going to the 4.70 MYR level. On the other hand, if we do break down from here, the 4.4 MYR will end up being a major support level as well.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.