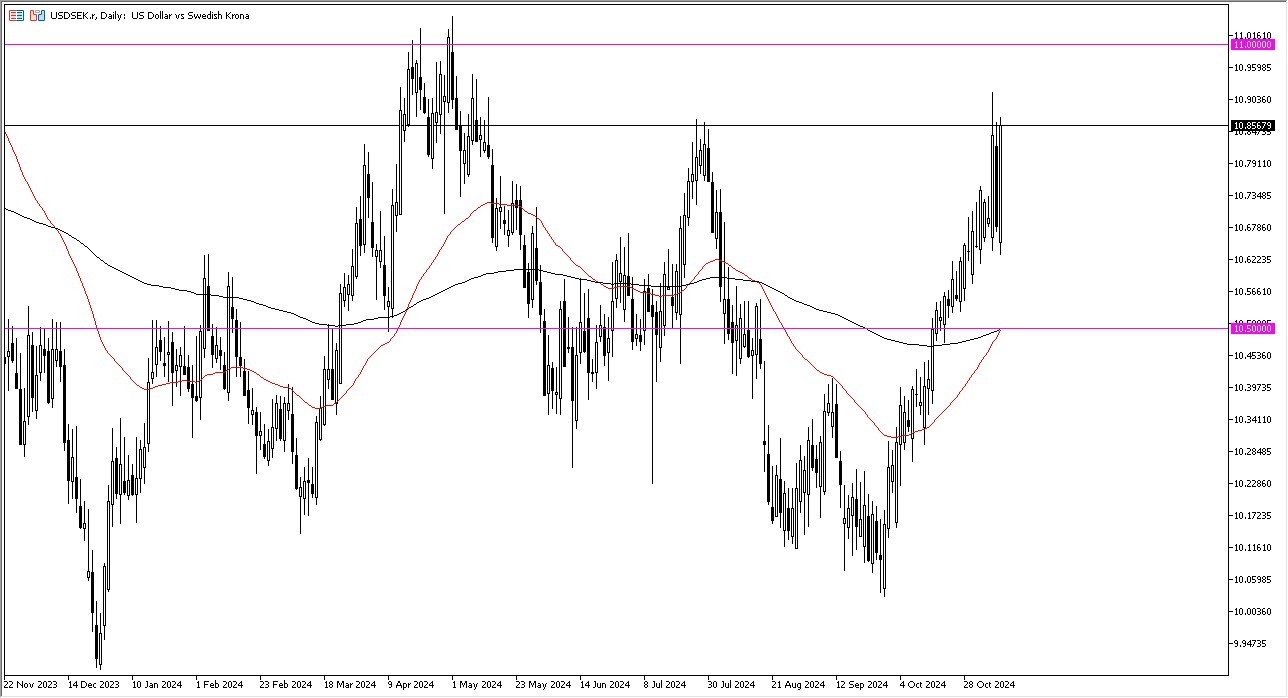

- During my daily analysis of exotic currencies, I’ve been paying close attention to the US dollar against the Swedish krona, as we are doing everything we can to break out to the upside.

- After all, we have seen a couple of huge candlesticks this week to the upside, and the US dollar has been rallying against almost everything out there, so the Swedish krona should be any different.

Top Forex Brokers

Short-term pullback at this point in time could certainly be expected, but I believe that the 10.65 SEK level will be important as far as short-term support is concerned. If we were to break down below there, then the market could go looking to the 10.5 SEK level underneath. Anything below there changes a lot of things, mainly due to the fact that it is not only is psychologically important level, but it also features the 50 Day EMA and the 200 Day EMA indicators. They are getting ready to cross, so therefore it would form the so-called “golden cross” that could really push things to the upside.

Risk Appetite

While the US dollar is considered to be a safety currency, the Swedish krona isn’t necessarily considered to be the same thing. With interest rates in the United States spiking regardless of what the Federal Reserve does, it makes a certain amount of sense that we would continue to see a lot of volatility in this market, and perhaps even upward pressure. If we were to break above the 11 SEK level, then I think the floodgates open, and we get a huge “FOMO trading” just waiting to happen.

Until then, I think we have got a situation where you have to think at this more or less from a short-term perspective than anything else. Short-term pullbacks probably open up the possibility of buying this market on dips, giving us a little bit of a value proposition that a lot of people will be paying close attention to.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.